“Retirement is wonderful if you have two essentials – much to live on and much to live for.” -Unknown

We are sure you have already asked yourself the question, “How much to save for retirement”? But do you have an answer for your current age and retirement score?

Continue reading for information about distinct savings benchmarks for individuals at 45, 50, and 60 years of age to ensure you’re on the right path to saving for retirement. Discover advised targets for your retirement savings and explore the various factors that may impact the requirements of your retirement.

Key Takeaways

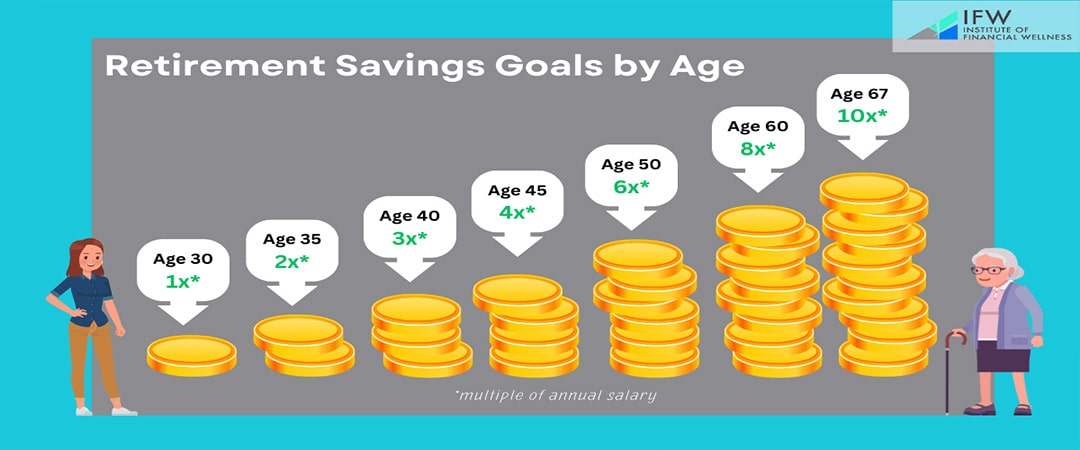

- Retirement savings benchmarks help gauge. Whether you’re on track by providing savings targets at various ages, such as 1x your salary by age 30, 3.5x to 6x by age 50, and 7.5x to 13.5x by age 65.

- Different factors affect your retirement age. Current age, planned retirement age, life expectancy, and healthcare costs significantly influence how much you need to save for retirement, with healthcare projected to account for 15% of retirement income.

- Maximizing your retirement income involves strategies. Taking full advantage of employer matching contributions, increasing your savings rate gradually, and diversifying income sources with tools like IRAs and annuities are some of them.

Understanding Retirement Savings Benchmarks

Wondering if you’re saving enough for retirement? Retirement savings benchmarks are like guideposts—they help you see if you’re on the right track.

While they don’t replace a detailed financial plan, they can motivate and guide your saving efforts. Having clear savings goals for different life stages can set you up for a secure future.

Remember, there’s no one-size-fits-all number for everyone’s retirement. What you need depends on your lifestyle plans.

Factors like your income, how you want to live after retirement, and expected healthcare costs all play a role. Knowing these benchmarks can help you figure out if you’re saving enough or if you need to adjust your savings plan.

Savings Multiples by Age

Saving for retirement can seem overwhelming, but knowing the recommended savings benchmarks for different ages can help keep you on track. These goals give you something concrete to aim for as you plan for the future.

- By age 30, aim to have saved at least one year’s salary. This provides a solid foundation and allows your savings to grow through interest and investment returns.

- As you progress in your career, your savings goals increase. By age 45, try to have saved between 2.5 to 4 times your annual income. Reaching these milestones is crucial as you get closer to retirement.

Understanding these targets can help you decide how much to save regularly and how to invest wisely. This way, you’ll be better prepared for a financially secure retirement.

Factors Influencing Savings Targets

What affects what you need to save for retirement?

Several factors influence how much you need to save for a comfortable retirement. Here’s what you should think about:

- Your Current Age: The younger you start, the more time your savings have to grow.

- When You Plan to Retire: Retiring earlier means you’ll need more savings to cover a longer period.

- Expected Lifespan: Living longer requires more funds to support yourself.

- Retirement Expenses: What you plan to spend during retirement matters a lot.

Debt is a big factor, too. Higher debt can make it harder to save for retirement. This issue is especially common among groups like African Americans, Hispanics, and single women due to challenges like wage gaps and fewer job opportunities.

Healthcare costs are another crucial consideration. It’s recommended to allocate about 15% of your income to medical expenses in retirement.

Rising healthcare costs and changing insurance benefits can put a big dent in your retirement savings.

Understanding these factors helps you set realistic savings goals and ensures you have enough money for a comfortable retirement.

How Much to Save for Retirement at Different Ages?

How do you make sure that you are on the right track in saving enough for retirement? It’s useful to follow some age-specific savings goals.

Here’s a simple guide to help you stay on target:

- By Age 35: Aim to save one to one-and-a-half times your current salary. This early start allows your money to grow with the help of compound interest.

- By Age 50: Work towards having three-and-a-half to six times your annual salary saved. This sets you up nicely as you get closer to retirement.

- By Age 60: Try to have saved between six to eleven times your yearly income. This is crucial as you approach retirement age.

- By Age 65: Aim for a nest egg that’s seven to thirteen times your annual earnings. This will help ensure a comfortable retirement.

Adjusting your savings plan as you go is key. These benchmarks can anchor your financial planning and keep you prepared for retirement at every stage of life.

In Your 30s: Accelerating Savings

As you navigate through your 30s, enhancing your savings practices becomes crucial for achieving retirement objectives. By the time you reach 35 years of age, it’s advisable to have accumulated an amount equal to or even one-and-a-half times that of your yearly earnings.

For instance, a 35-year-old who earns an annual income of $60,000 should ideally have between $60,000 and $90,000 in savings. Achieving this level of savings serves as a solid indicator of financial health, given one’s current age and earnings.

Attaining such milestones in saving acts as a foundation for ensuring a more relaxed and financially secure retirement period.

In Your 40s: Catching Up

By the time you reach 50 years old, it’s recommended to have accumulated savings that amount to between three and a half and six times your salary before retirement. Currently, for individuals in their 40s, the typical balance within a 401(k) plan is $76,354 on average, with a median of $28,318.7.

Should your retirement savings fall below these averages, now is the critical period to boost your contributions utilizing pre-tax income as part of an effort to bridge any gaps prior to entering retirement.

In Your 50s: Preparing for Retirement

By the time one reaches 60 years old, it is advised to accumulate retirement savings equivalent to six to eleven times their annual salary. Fidelity suggests aiming for eight times your yearly earnings saved in your 401(k) by this age.

For those lagging in meeting their retirement goals, making catch-up contributions can significantly enhance their savings.

In Your 60s: Final Stretch

By the time you reach age 65, it’s recommended to have amassed retirement savings amounting to 7.5 to 13.5 times your annual income. The ideal average balance in a person’s 401(k) who is in their sixties is approximately $182,100.

It’s imperative at this stage of life to carefully plan for one’s anticipated needs regarding retirement income.

As one nears the age of retirement, it becomes prudent to shift their investment strategy towards more conservative options within their portfolio as a means of protecting accumulated savings. To enhance your future retirement funds, consider increasing contributions toward your 409(k).

Calculating Future Expenses

When planning for retirement, knowing how much you’ll need to spend is essential. Think about how your costs might change once you stop working, especially in areas like lifestyle and healthcare.

Here’s a simple guide to help you estimate and prepare:

- Estimate Retirement Expenses:

- Healthcare: Expect to spend more on medical care as you age. Healthcare costs can be a significant part of your retirement budget. Consider how these expenses could impact your overall retirement savings.

- Housing: Consider if you’ll downsize, relocate, or need to make home modifications. Housing costs can fluctuate, and your living arrangements will significantly affect your financial planning.

- Daily Living: Your day-to-day expenses might decrease, but you’ll still need to budget for things like food, transportation, and leisure activities. Estimating your potential retirement expenses can help you set a realistic savings goal.

- Retirement Age Matters: The age at which you retire will influence how long your savings need to last. Retiring earlier means you’ll need more savings to cover a longer period. Your current age and desired retirement age are crucial factors in determining how much you need to save for retirement.

- Spending Guidelines: Typically, you can expect to spend between 55% and 80% of your pre-retirement annual income each year during retirement. This range accounts for reduced work-related costs but includes potential increases in healthcare and leisure activities.Understanding your pre-retirement salary and how much of it you’ll need can help you estimate your future retirement income needs.

- Account for Inflation: Don’t forget to factor in inflation. Over time, prices for goods and services generally increase, which can reduce your purchasing power.Make sure your savings plan considers how inflation might affect your future expenses. This is crucial for maintaining your desired lifestyle and ensuring you have enough money to cover your costs.

- Set Realistic Savings Goals: By understanding these potential expenses, you can set realistic savings goals. This helps ensure you have enough funds to enjoy your retirement comfortably.Consider consulting a financial advisor to develop a robust retirement savings plan tailored to your needs.

Planning ahead with these considerations will help you build a solid financial foundation, giving you peace of mind and financial security in your retirement years. Start saving early, take advantage of retirement accounts like a 401(k) or an Individual Retirement Account (IRA), and regularly review your investment strategy to stay on track.

Estimating Healthcare Costs

Getting close to retirement? Don’t overlook healthcare costs and inflation!

As you approach retirement, it’s crucial to think about potential healthcare expenses and other costs you might face. Here are some key points to keep in mind:

1. Plan for Healthcare Costs:

- Medicare Costs: For example, in 2023, Medicare Part B had a monthly premium of $164.90. This highlights the importance of setting aside funds specifically for health-related expenses.

- Rising Healthcare Expenses: As you get older, you’ll likely spend more on healthcare. After age 75, these costs might decrease slightly, but it’s wise to be prepared for higher expenses overall.

2. Don’t Forget Inflation:

- Impact on Purchasing Power: Inflation can erode the value of your savings over time, making it crucial to factor in rising costs when planning your retirement budget.

- Annual Costs Over Lifetime Sums: Instead of trying to predict your total healthcare costs for your entire retirement, it’s more practical to estimate what you might spend each year. This approach simplifies planning and helps you stay on track.

3. Estimate Lifespan and Costs:

- Longevity and Expenses: Misjudging how long you’ll live can lead to underestimating how much you’ll need for healthcare and other living expenses. Plan for a longer lifespan to avoid running out of funds.

By keeping these factors in mind, you can create a more accurate and realistic financial plan, ensuring you’re well-prepared for retirement.

Lifestyle Considerations

As you plan for retirement, consider the wide range of expenses related to travel and recreational activities. Traveling domestically for a week-long vacation can cost about $1,500 per person, but international trips can be much more expensive.

Your choice of hobbies and leisure activities, whether it’s golf, pickleball, or enjoying quiet time with a book, will also impact your retirement finances significantly.

When planning how to generate income after retiring, it’s essential to consider several factors beyond just finances. Think about your desired lifestyle, family responsibilities, health needs, and community involvement.

These elements play crucial roles in shaping your retirement strategy.

Maximizing Your Retirement Income

Preparing for retirement involves assessing multiple factors: income sources during retirement, the effects of inflation, and healthcare expenses. It’s crucial to align your investment strategy with your post-retirement income needs.

Planning for diverse sources of retirement income ensures a steady cash flow throughout your retirement years.

Maximizing Social Security benefits and diversifying income streams can boost your retirement income significantly. These strategies help fill potential savings gaps and provide a financial safety net during retirement.

Social Security Benefits

Preparing for retirement involves evaluating several key factors: income sources during retirement, the impact of inflation on your savings, and healthcare expenses. It’s essential to tailor your investment strategy to meet your income needs after retiring.

Diversifying your sources of retirement income ensures a stable financial flow throughout your retirement.

Maximizing Social Security benefits and expanding your income streams can substantially increase your retirement income. These approaches not only help cover potential savings shortfalls but also provide a reliable financial cushion during retirement.

Diversifying Income Sources

Establishing an individual retirement account (IRA) alongside your 401(k) can enhance your retirement savings with extra tax advantages and potential for growth. Annuities offer a steady, guaranteed income stream that can last for life or a predetermined time frame, offering dependable support in later years.

It’s essential to recognize all the different sources of income available when planning for retirement. Such sources include:

- Social Security benefits

- Pension funds

- Investment returns

- Earnings from rental properties

- Income from part-time employment

By spreading your financial resources across various streams, you can secure consistent and reliable income throughout the span of your retirement.

Staying on Track with Retirement Savings

Periodic examination of your retirement account statements is crucial as it allows you to:

- Quickly identify and resolve any discrepancies or problems

- Continuously evaluate and modify your plan for saving for retirement, confirming alignment with your financial objectives

- Set up automatic transfers to maintain a steady flow into your savings without having to manually transfer funds each time.

- Engage the expertise of a financial advisor who can ensure that the allocation of assets within your retirement portfolio remains suitable in terms of risk.

Maintaining momentum towards accumulating adequate savings for retirement requires leveraging several strategies. These include maximizing employer matching contributions when available, progressively increasing the percentage you save from earnings, and participating in any financial health programs offered by employers – all designed to foster consistent growth in your retirement fund.

Taking Advantage of Employer Contributions

When you make contributions to your 401(k) plan, employer matching can be a powerful tool for enhancing your retirement savings. It’s like receiving ‘free money’.

Not fully utilizing this benefit is similar to neglecting free cash that could significantly increase your savings for retirement. The exact match formula varies by employer.

Some may offer a dollar-for-dollar match up to a set percentage of your salary—thus optimizing the value of your saved funds.

If it aligns with your financial situation, strive not only to contribute enough to get the full employer match but also consider contributing the maximum amount allowed into your 401(k). Exploring other saving avenues beyond just maximizing this account should be part of an all-encompassing strategy for amassing adequate money for retirement.

Gradual Savings Increases

By progressively boosting the amount you save for retirement, you can accumulate a more substantial sum in your account without greatly impacting your current finances. Incremental hikes to how much you set aside regularly can lead to considerable growth in your retirement funds through compounding over the years.

Automatic contribution increases provided by many retirement accounts make it easier to adjust and enhance your savings rate each year.

Aiming for an annual 1% rise in the portion of income directed towards savings could have a profound impact on one’s financial security at retirement. To illustrate, after five years of saving, $15,748 would accumulate with a 5% savings rate versus $18,897 when that figure is increased slightly to 6%.

Utilizing Financial Wellness Programs

Employer-provided financial wellness programs can be instrumental in enhancing your ability to manage finances and accumulate retirement savings. They typically offer a suite of services, including:

- Budgeting and saving tools aimed at retirement preparation

- Informative workshops on various financial topics

- Personalized coaching for individual finance management

- Digital resources designed for making educated financial choices

Leveraging such financial wellness programs is key to forging an all-encompassing fiscal strategy that supports your long-term aspirations for retirement. A solid understanding of financial concepts is vital when it comes to bridging any deficiencies in retirement savings.

Dealing with a Savings Gap

Should you find your retirement savings lacking, it’s essential to adjust and begin the ascent towards your intended target. Falling behind on the trajectory for retirement accounts might be due to unforeseen medical bills, furthering one’s education, or covering children’s college costs.

A comfortable retirement may necessitate stashing away 23% of your income each month. This could translate into putting aside $1,950 monthly until you retire.

Bridging a savings gap can pose difficulties. There are ways to make up ground.

One might think about shrinking living space or diminishing debt as means to unlock additional funds designated for saving for retirement. Also considering extending working years or seeking part-time employment not only brings in supplementary revenue but also diminishes early depletions from your savings earmarked for later life expenses — giving that nest egg extended time to expand.

Downsizing and Reducing Debt

Reflect on possible adjustments to housing costs, like the option of downsizing or relocating to a community designed for retirees. Transitioning to a smaller residence could release considerable capital that bolsters your retirement fund, cutting down on various expenses, including mortgage installments, property taxes, insurance premiums, and upkeep outlays.

Opting for more modest accommodation can streamline daily living while possibly providing extra money to enhance retirement savings. It’s essential to eradicate debt with steep interest rates in order to bolster financial security as you approach retirement.

Tackling outstanding debts is imperative for liberating funds that can be directed towards augmenting your nest egg for retirement.

Working Longer or Part-Time

Delaying retirement or engaging in part-time employment can contribute to narrowing the savings shortfall for retirement by providing supplementary income. Prolonged employment postpones disbursements from retirement accounts, thereby granting those savings additional time to accumulate.

Engaging in volunteer work or securing a part-time job can also supplement income and diminish the amount required to be drawn from retirement savings.

Pursuing opportunities for part-time or flexible work arrangements may serve as a means of diversifying sources of income during retirement. Maintaining some level of professional activity post-retirement assists in bridging any gaps between savings and needed income, thus providing an enhanced financial cushion.

Empowering Financial Futures: The Institute of Financial Wellness (IFW)

The Institute of Financial Wellness (IFW) stands as the premier multi-media network, offering an extensive range of financial education materials, resource tools, and related services. With our vision to assist individuals in achieving their ideal lifestyle, IFW delivers:

- Compelling educational content on finance

- Informative digital newsletters

- Interactive webinars

Such offerings are structured with the aim to equip people with knowledge for well-informed financial choices.

Central among IFW’s array of benefits is the Retirement Score Webinar—a tool geared towards empowering families and individuals to fulfill their most ambitious retirement aspirations without fear of depleting funds or facing losses due to market fluctuations.

The Financial Check-up service provided by IFW ensures one’s financial wellness remains poised for lasting prosperity. The connection with a professional network available through IFW enables personalized solutions catering specifically to individual requirements.

Thanks to its compelling narratives and impartial perspective, accessing enriching financial literacy via IFF becomes not just simple but also engaging.

Full Summary

To secure a comfortable retirement, it is vital to establish clear benchmarks for your retirement savings. Keep in mind the ideal saving milestones by age while factoring in healthcare costs and lifestyle preferences to set attainable targets for your savings and monitor progress effectively.

Planning ahead involves estimating potential expenses and enhancing your future income with diversified sources alongside Social Security benefits.

It’s important to emphasize that beginning the journey of saving for retirement can begin at any stage of life. Leveraging employer contributions, increasing your rate of saving incrementally, and participating in financial wellness initiatives are proactive measures you can take advantage of.

If faced with insufficient savings, strategies such as downsizing living arrangements, debt reduction, or extending one’s working years—even through part-time employment—may be considered necessary steps toward closing any gaps in savings. The Institute of Financial Wellness offers valuable tools and advice designed to assist you in meeting your long-term goals related to retiring comfortably—empowering you today to achieve security during retirement tomorrow!

Frequently Asked Questions

How many people have retired in the US in the past years?

From 2000 to 2011, the proportion of the U.S. population aged 16 and over who were retired remained relatively stable, fluctuating between 15% and 16%. However, since January 2012 (16.1%) up to March 2022 (19.3%), this figure has steadily risen. This upward trend is primarily due to a significant number of baby boomers reaching retirement age [1].

How much should I have saved for retirement by age 45?

You should target saving between 2.5 to 4 times your annual income by the time you reach the age of 45, as a foundation for your retirement.

It is crucial to begin strategizing and accumulating savings immediately in order to achieve this objective.

What percentage of adults are retired in the US?

A significant segment of the adult population consists of retirees. In 2020, 27% of adults identified as retired, even if some were still engaged in work to some extent. Among retirees, 13% had engaged in paid or profitable work in the previous month. As a result, 4% of all adults considered themselves retired while still actively working. Retirees with higher levels of education were more inclined to continue working during retirement [2].

What are the recommended savings multiples by age?

Different age milestones suggest varying savings goals: at age 30, strive to save an amount equal to your yearly salary. By the time you reach 35, target saving between one and one-and-a-half times that figure. Continue this progression until you attain the age of 65.

What factors influence how much I need to save for retirement?

To determine the necessary amount to save for retirement, you must take into account various elements such as your age at present, when you intend to retire, how long you expect to live during retirement, anticipated expenses after retirement, and potential sources of income upon reaching retirement.

These factors are crucial in defining the goal for your savings.

What are the household retirement savings in the U.S. 2020-2022?

By the end of 2022, about 29% of Americans had household retirement savings amounting to $250,000 or more. Conversely, 9% of respondents reported having no household retirement savings at all. The proportion of individuals with retirement savings ranging from $100,000 to $250,000 decreased from 2020 to 2022 [3].

How can I stay on track with my retirement savings?

Ensure that you are maximizing your retirement savings by leveraging employer contributions, incrementally boosting your rate of savings, and participating in any financial wellness programs provided by employers.

By doing so, you will enhance your ability to achieve the financial targets set for your retirement.

What should I do if I have a savings gap?

Should you find yourself with a shortfall in your retirement savings, think about downsizing to a smaller residence, diminishing debt levels, and extending your career or seeking part-time employment as strategies to augment your savings for retirement.

Adopting these measures can be instrumental in closing the distance on any deficit within your retirement fund and ensuring an improved financial standing for the future.