“Retirement is not the end of the road. It is the beginning of the open highway.” – Author Unknown

Understanding how to borrow money tax-free is crucial if you’re seeking ways to access cash without the tax toll. Brace yourself because we will steer you through options such as HELOCs and securities-backed loans, both smart ways to use your assets while avoiding taxes on the gains. We’ll delve into these strategies and more to keep your finances fluid and your tax liability in check.

Borrowing money tax-free can impact your retirement and financial health. Learn your retirement score today with Institute of Financial Wellness and ensure your financial future!

Key Takeaways

- Borrowing against assets like real estate and securities allows individuals to access funds without incurring capital gains taxes, using financial tools such as HELOCs and SBLOCs to leverage appreciating assets efficiently.

- In estate planning, loans can effectively minimize estate taxes. Intrafamily loans enable wealth transfer within the family without affecting the lender’s lifetime exemption amount, thereby reducing the taxable estate size.

- Managing risk is essential in tax-free borrowing, and maintaining liquidity and employing strategies like interest rate swaps can safeguard against interest rate fluctuations and ensure the ability to meet loan obligations.

Unlocking Tax-Free Loans: The Basics of Borrowing Without a Tax Hit

Diving into the sphere of tax-exempt lending offers an opportunity to obtain funds while circumventing tax obligations. When you borrow against your holdings, you avoid the need to pay capital gains taxes, as loan proceeds are not regarded as taxable income [1]. This strategy operates like a delicate dance in personal finance—meticulously orchestrated moves such as utilizing home equity lines of credit (HELOCs) or leveraging stocks allow for careful avoidance of capital gains liabilities.

This financial maneuvering is akin to a sophisticated ballet that provides dual tax advantages, safeguarding your assets from falling prey to taxation inefficiencies.

Choosing the Right Assets to Secure Loans

Opting to secure loans with assets that increase in value, such as real estate or stocks, is the key to obtaining financing without incurring a tax burden. You are effectively investing in a future where the worth of your investments multiplies over time by choosing these appreciating assets. They not only appreciate but also enable borrowing that minimizes taxes, thereby enhancing the efficiency of each borrowed dollar.

Lenders prefer tangible collateral like real estate due to its stable nature, providing you with a robust base for all your loan requirements [2].

Understanding Loan Terms and Interest Rates

Understanding the complexity of loan terms and interest rates is essential to obtaining loans that fit your financial plans [3]. The duration of your loan determines your monthly payments, as well as the total amount of interest you’ll incur—opting for shorter periods could result in larger monthly payments but a lower amount paid in interest over the life of the loan. Fixed-rate loans provide stability amidst market volatility, helping to maintain consistency in your financial strategy despite potential upheavals due to fluctuating interest rates.

Achieving beneficial terms demands mastery similar to an art form. It requires profound insight into lenders’ considerations and skilled negotiation when discussing those terms.

Leveraging Securities: Borrowing Against Your Portfolio

Leveraging a Securities Backed Line of Credit (SBLOC) can be an effective element in your strategy to build wealth if you have a stock portfolio. It serves as a channel for accessing cash without triggering capital gains tax because it allows you to borrow money with typically more favorable interest rates than other types of loans, enabling the use of your investment portfolio as collateral without having to liquidate it.

Employing this method enables your investments to potentially grow in value while avoiding the tax repercussions associated with selling assets, thereby circumventing immediate capital gains taxes and allowing strategic borrowing that keeps your long-term financial plan intact.

And if all of this sounds too complicated, get in touch with a trustworthy financial advisor. Contact us at The Institute of Financial Wellness for advice.

Navigating Market Volatility While Borrowed

Taking a loan against your investment portfolio carries its own set of difficulties, notably in the face of market fluctuations. Your defense lies in diversification, which entails distributing your pledged assets across multiple industries to reduce exposure to risk. Continually setting and adjusting limits on how much you concentrate your investments according to your willingness to take risks requires constant attention.

Maintaining open communication with your lender about these concentration boundaries is crucial so that both sides are clear on the terms of the borrowing arrangement. By employing deliberate tactics like putting capital into stocks with short maturity periods or Exchange-Traded Funds designed for navigating interest rate volatility, you can safeguard yourself from unexpected changes in the market and rising interest rates.

Wednesdays 2:00 pm ET

Webinar: New Rules of Retirement Income Planning

Retirement has changed. Are you prepared? Learn how to build lasting and reliable income.

Reserve My Spot

Aligning Investment Strategy with Borrowing Goals

It is essential for your investment strategy to align with your borrowing objectives. Having well-defined financial goals allows you to make investment choices that are consistent with what you hope to achieve in the long run. Maintaining a balance within your investments while considering short-term and long-term aspirations helps create a robust portfolio capable of adapting to various economic fluctuations.

Staying on track requires frequent adjustments of your portfolio, which should include strategies such as adding interest-rate-hedged bond funds that can strengthen your position in the face of increasing interest rates.

Real Estate Equity: Tapping into Your Property’s Value

Tapping into the financial reservoir of your property’s worth, a Home Equity Line of Credit (HELOC) acts as compelling evidence of the advantages of borrowing against your home equity without activating any capital gains tax. This dynamic financing option offers homeowners the freedom to:

- Access their home’s value at their discretion

- Allocate those funds towards diverse needs such as upgrading their house, consolidating debts, or funding educational pursuits

- Incur interest charges solely on the sum drawn

- Gradually repay the amount utilized

Utilizing this approach allows you to convert accumulated equity in your residence into accessible cash while bypassing potential taxation associated with selling.

Home Improvements vs. Personal Use: Best Practices

Succumbing to the temptation of using HELOC funds for various personal expenses can be easy, but a savvy investor would direct these resources toward home upgrades. These improvements enrich your living environment and elevate your property’s market value. Notably, these renovations could make you eligible for tax deductions if they significantly enhance the home. This presents a dual boon of both escalating property value and realizing tax benefits.

This approach embodies strategic investing whereby each dollar allocated to refurbishments has the potential to yield an increased return through enhanced value and tax advantages.

Refinancing Options: Cash Out for More Flexibility

Should a Home Equity Line of Credit (HELOC) not match your financial needs, consider the robust option of cash-out refinancing. This method provides a single lump sum, enabling you to refinance for an amount exceeding your existing mortgage and take the surplus. It presents a chance to revise your mortgage conditions, potentially obtaining an improved interest rate or more suitable terms that correspond with your present financial circumstances.

Eligibility for cash-out refinancing requires an assessment of both your credit score and debt-to-income ratio. Upon approval, it can enhance your monetary agility when tackling big-scale projects or significant expenses.

What is the best option for you? A financial advisor can help you determine the most convenient course of action depending on your personal goals and situation.

The Art of Estate Planning: Minimizing Estate Tax Through Loans

Effective estate planning encompasses both the growth and safeguarding of wealth to benefit subsequent generations. A critical aspect of this objective is reducing estate taxes, where loans can be instrumental.

Given the existing thresholds for estate tax, shrewd utilization of lending tactics can help diminish the taxable value of an estate. This approach aids in lowering the burden of estate taxes and ensures a more substantial inheritance for your descendants.

Estate Tax Threshold and Asset Valuation

Grasping the concept of the estate tax threshold is crucial for effective estate planning. As of 2024, this limit is set at $13.61 million, and strategizing to stay within this limit can significantly shape your estate’s tax liability [4]. When assessing assets included in an estate, it’s essential to understand that their worth is measured by current fair market value rather than what was paid for them originally. Thus, a clever assessment tactic is required to ensure the true value of the estate is captured.

For couples who are married, employing a portability election strategy allows any remaining exemption amount from one spouse to be carried over to the surviving partner upon death—a move with substantial potential ramifications on how much taxes might affect one’s legacy.

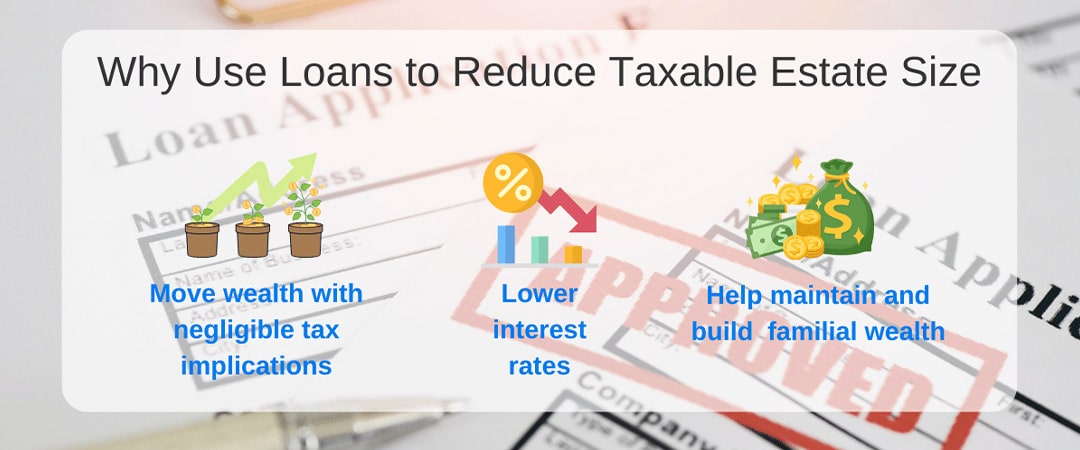

Utilizing Loans to Reduce Taxable Estate Size

In the realm of estate planning, intrafamily loans stand as a strategic tour de force. They bring to the table numerous advantages, such as:

- The ability to move wealth with negligible tax implications

- Interest rates that frequently undercut those offered by commercial financial institutions

- The retention of interest payments within family boundaries aids in maintaining and building familial wealth over successive generations.

When set up properly, intrafamily loans enable the transfer of substantial assets without eroding the lender’s lifetime exemption total, thus effectively shrinking the size of their taxable estate.

Avoiding Common Pitfalls: Risk Management in Tax-Free Borrowing

There is a constant presence of risk within the domain of borrowing without tax implications. Variability in interest rates represents a considerable hazard to the affordability of such loans. Borrowers need to navigate cautiously and with foresight when it comes to secured personal loans and securities-backed lines of credit (SBL) since margin calls can pose serious risks.

Failure to meet payments on home equity loans or lines of credit can result in the severe consequence of potentially losing one’s residence, highlighting the critical need for meticulous planning and effective risk management.

Preparing for Interest Rate Fluctuations

Navigating the volatile landscape of interest rates requires readiness for their inevitable variability. Employing protective strategies like interest rate collars and futures can shield you from market whims.

Interest rate swaps, which allow you to swap a variable interest rate for a fixed one, are particularly useful in this endeavor. Anchoring interest costs provides stability in long-term financial planning.

Ensuring Liquidity for Loan Repayment

Maintaining liquidity to meet loan repayments is like ensuring your ship stays afloat in choppy financial waters. Here are some strategies to help you navigate through any financial storm.

- Manage cash flow effectively

- Control expenses and reduce unnecessary spending

- Establish a safety net, such as a line of credit, to provide stability in times of need

By implementing these strategies, you can ensure that you have the necessary liquidity to meet your loan repayments and maintain financial stability.

Selling unneeded assets or revising debt obligations can also contribute to a more balanced financial position, securing the liquidity required for loan repayments. Ask your financial advisor how to proceed with these strategies.

Comparing Wealth Strategies: When to Choose Borrowing Over Selling

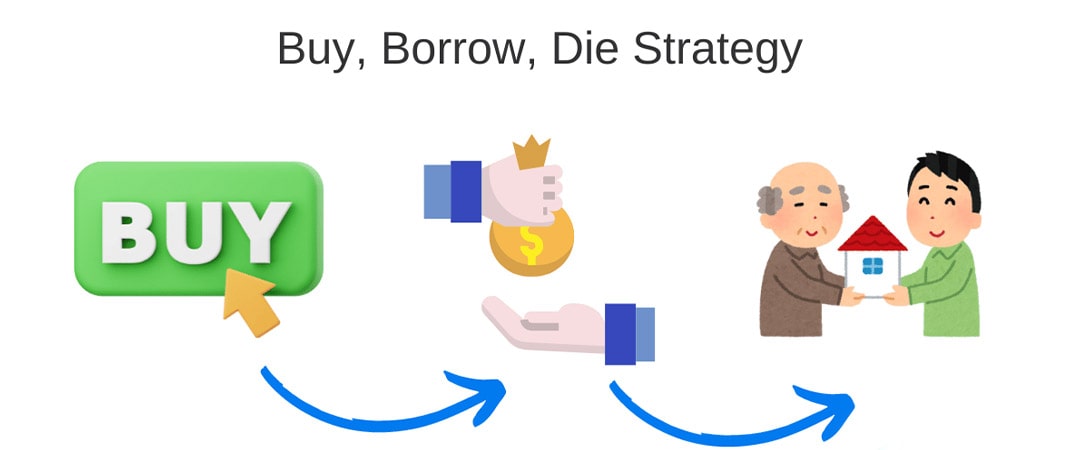

Choosing whether to take out a loan or sell assets is critical in the quest for wealth accumulation. The ‘buy, borrow, die’ strategy encapsulates this crucial decision and provides an option to access liquidity from one’s holdings without interrupting the growth of their investment portfolio or triggering capital gains tax liabilities.

The ‘buy, borrow, die’ method proves especially beneficial when addressing significant financial obligations like paying taxes or covering educational costs.

The “Buy Borrow Die” (BBD) strategy is a financial planning approach that centers around the idea of utilizing assets to generate wealth over one’s lifetime and eventually passing them on to heirs, with minimal tax implications. This strategy is often associated with managing assets such as real estate, stocks, and other investments. Here’s how it works:

- Buy: The first step in the BBD strategy involves acquiring appreciating assets, such as real estate or stocks, with the intention of holding onto them for the long term. The goal is to invest in assets that are likely to increase in value over time, thereby growing one’s wealth.

- Borrow: Once assets have been acquired, individuals can leverage these assets to access liquidity through borrowing against them. This could involve taking out loans or lines of credit secured by the value of the assets. By borrowing against the assets instead of selling them, investors can access funds without triggering capital gains taxes or other tax implications associated with selling appreciated assets.

- Die: The final stage of the BBD strategy involves passing on the assets to heirs upon death. Because assets receive a “step-up” in basis upon inheritance, any capital gains that have accrued during the original owner’s lifetime are effectively wiped out. This means that heirs can sell the assets shortly after inheriting them with minimal or no tax consequences, allowing them to enjoy the full value of the assets without being burdened by taxes.

Some of the key benefits of the Buy Borrow Die strategy include:

- Tax Efficiency: By strategically borrowing against assets instead of selling them, individuals can minimize their tax liabilities, particularly capital gains taxes. Additionally, assets passed on to heirs receive a step-up in basis, further reducing potential tax burdens.

- Liquidity: The ability to borrow against assets provides individuals with access to liquidity without having to sell off their investments. This can be particularly useful for funding expenses or investments without disrupting long-term financial plans.

- Wealth Preservation: By holding onto appreciating assets and passing them on to heirs, the BBD strategy allows individuals to preserve and potentially grow their wealth over time, benefiting both current and future generations.

However, it’s important to note that the BBD strategy may not be suitable for everyone, as it requires careful planning and consideration of individual financial circumstances, including risks associated with borrowing and market fluctuations. Additionally, tax laws and regulations may vary by jurisdiction, so individuals considering implementing this strategy should seek professional financial advice to ensure it aligns with their specific goals and situation.

Evaluating Immediate Cash Needs vs. Long-Term Growth

Assessing the necessity for immediate liquidity while considering future expansion potential requires careful consideration. Securing a loan at a lower rate of interest in the short term to meet pressing financial needs can prove beneficial if expected long-term gains surpass associated expenses. It’s crucial to judiciously access cash so as to maintain equilibrium between near-term obligations and prospective growth over time.

For individuals with substantial assets, leveraging loans against the cash value of life insurance policies may represent an integral tactic within their broader financial strategy.

Assessing the Impact of Selling vs. Borrowing on Net Worth

Borrowing as a key strategy instead of liquidating assets can play a crucial role in safeguarding your net worth. This approach enables you to maintain your investments and remain poised to benefit from possible appreciation while simultaneously addressing your liquidity requirements.

Navigating Tax Laws: Keeping Up With Changes

The complex and continuously evolving nature of tax legislation can significantly affect your tax liability and approaches to borrowing. It is essential to remain up-to-date with these modifications to preserve efficient strategies for borrowing from a tax perspective, guarantee adherence to regulations, and ascertain the appropriate timing for paying taxes.

Anticipating Legislative Shifts

Proactively preparing for changes in legislation is a key step to protect your financial tactics. Financial specialists are vital as they:

- Decode tax regulations

- Forecast the impact of forthcoming alterations on borrowing techniques

- Develop plans designed to withstand potential shifts in law

- Maintain the effectiveness of strategies aimed at minimizing tax liabilities.

Consulting with Financial Experts

In the intricate realm of borrowing, while minimizing tax impact, the counsel of financial professionals is crucial. These experts offer clarity on advanced tactics and assist you in:

- Tweaking your strategies to align with updates in tax laws

- Amplifying your entitlement to tax reductions and incentives

- Reducing what you owe in taxes

- Enhancing your overall fiscal status

With a robust understanding of where you stand financially, bolstered by specialist guidance, you can enhance your leverage when negotiating with creditors.

Preserving Wealth: Strategies for High Net Worth Individuals at The Institute of Financial Wellness

Step into the realm of The Institute of Financial Wellness, a stronghold dedicated to financial literacy and supportive tools. Committed to providing captivating and insightful content, our institution equips people with the necessary information to take control of their finances confidently. We offer an extensive array of services and learning resources that span various subject matters such as retirement planning, strategies for saving for college education, effective budgeting and savings tactics, investment insights, debt handling techniques, and insurance understanding.

Whether you are at the outset of managing your personal finances or seeking ways to enhance your existing monetary condition, the Institute of Financial Wellness stands ready with all the essential materials tailored to help you accomplish your fiscal objectives.

Full Summary

Throughout this exploration, we have navigated the nuanced strategies of tax-efficient borrowing, from leveraging real estate equity to borrowing against securities. The ‘buy, borrow, die’ method is more than a wealth strategy—it’s an approach to sustain and grow your financial legacy. By mastering these tactics and staying abreast of tax laws, you are equipped to make decisions that will preserve your wealth and enhance your financial well-being for generations to come.

See How You Can Boost Your IFW Retirement Score

When you request your IFW Retirement Score, an IFW Certified Financial Professional will help you discover ways to:

Lower or potentially eliminate taxes in retirement

Protect your retirement portfolio

Secure a stable income stream throughout retirement

Frequently Asked Questions

Can you get a personal loan to pay off taxes?

Before deciding to use a personal loan to pay off taxes, consider alternative options like an IRS payment plan or hardship extension. Personal loans can come with extra fees and interest, particularly for individuals with a low credit score.

While personal loans can be quick to secure, they tend to be a pricier form of borrowing.

Why do the rich take out loans?

Wealthy individuals often opt for loans as a strategic financial move. This lets them utilize their money without activating capital gains taxes and helps diversify their portfolio by employing debt as an instrument to accumulate additional wealth.

Their decision to borrow does not stem from extravagant spending or poor fiscal management.

How can I use my debt to avoid paying taxes?

The strategy known as “Buy, Borrow, Die” involves purchasing assets that are expected to increase in value and using leverage by borrowing against them. This approach allows you to pass on the assets to your heirs, who can then sidestep capital gains tax liabilities upon inheritance. It’s critical, though, to meticulously handle the associated risks associated with this financial maneuver.

What exactly is the ‘buy, borrow, die’ strategy?

The ‘buy, borrow, die’ strategy involves acquiring assets and then leveraging their increased value through loans. This allows affluent individuals to tap into the value of their holdings without incurring capital gains taxes. By employing this tactic until death, it is possible to minimize estate taxes and thereby maintain wealth across generations.

How does borrowing against assets help avoid capital gains tax?

Borrowing against assets helps avoid capital gains tax because, by receiving loan proceeds without selling the assets, you’re not realizing any capital gains. This strategy is often used through options like HELOC or SBLOC.