In today’s uncertain economic climate, securing a stable income during retirement has become more important than ever. With inflation on the rise, it’s crucial to find strategies that can help beat inflation and ensure a comfortable retirement.

One such strategy is investing in annuities, which provide a guaranteed income stream during retirement and can be tailored to suit your individual needs. A common question that arises is, “How much does annuity pay?”

In this blog post, we will delve into the world of annuities, exploring how they work, the different types available, and how to calculate monthly payments. We will also discuss how to maximize annuity payouts and the risks and considerations to keep in mind when investing in these financial products.

By understanding the ins and outs of annuities, including how much does annuity pay, you will be better equipped to make informed decisions and secure your financial future.

Quick Summary

- Annuities are a reliable source of income in retirement, with the amount invested and age affecting monthly payments.

- Strategies such as delaying payouts and choosing appropriate payout options can maximize annuity payouts during retirement.

- Understanding associated risks, fees and expenses, inflation and purchasing power, and market conditions is essential for making informed financial decisions to secure your future.

Understanding Annuities

Let’s start from the top. What are annuities? Annuities are insurance products that provide a guaranteed income stream during retirement, ensuring a consistent flow of money even when the economy is in flux. Unlike other investment options such as mutual funds, annuities pay a predetermined amount, which can be influenced by several factors, including your age, gender, and interest rates.

Understanding how annuities work is crucial for making informed decisions and optimizing your retirement income as part of your planning for retirement.

Types of Annuities

There are various types of annuities, each with its own features and benefits. Fixed annuities guarantee a predetermined amount for the duration of the contract, offering a reliable source of income and protection against market fluctuations and higher prices due to inflation.

Variable annuities, on the other hand, fluctuate based on the returns of mutual fund investments and can be affected by rising interest rates. They provide the potential for higher returns but also possess more risk, including the impact of the inflation rate on the investment.

Indexed annuities are linked to a stock market index, offering the possibility of higher returns with less risk than variable annuities. They can be a good alternative to treasury inflation-protected securities for those looking to combat inflation and keep up with the consumer price index.

How Annuity Payments Work

Since we are discussing this subject, it’s important to understand how annuity payments work. When you acquire an annuity contract, you make a lump-sum payment or a series of payments to an insurance company or financial institution.

In return, the institution will provide you with regular annuity pay, typically on a monthly basis. The amount of these income payments is determined based on factors such as the initial investment, interest rates, the current inflation rate, and the chosen payout option.

It is important to carefully consider these factors when selecting an annuity to ensure that it meets your needs and provides the desired level of income. By learning how to budget for retirement, you can learn how to select the annuity that works best for you.

Calculating Monthly Annuity Payments

Calculating monthly annuity payments involves considering factors like age, gender, and interest rates, which can be affected when inflation rises. Using an annuity calculator can help estimate potential payouts, taking into account factors such as the initial investment, the annuitant’s age, and the impact of raising interest rates.

By understanding how these factors influence your monthly income, you can make more informed decisions about which annuity product is right for you and stop thinking about living from paycheck to paycheck.

Factors Affecting Annuity Payments

Several factors influence annuity payments, such as:

- Prevailing interest rates

- The amount invested

- Age

- Gender

- The duration of payments

- The type of annuity selected

Interest rates, in particular, can have a direct bearing on the amount of money paid out in annuity payments. An increase in interest rates results in increased annuity payments, while a decrease leads to decreased payments.

The amount deposited into an annuity is directly correlated to the amount of money that is paid out in annuity payments, with higher deposits generally leading to greater payments. Why is all of this important? Because by considering these factors when selecting an annuity, you can ensure that it meets your needs and provides the desired level of income.

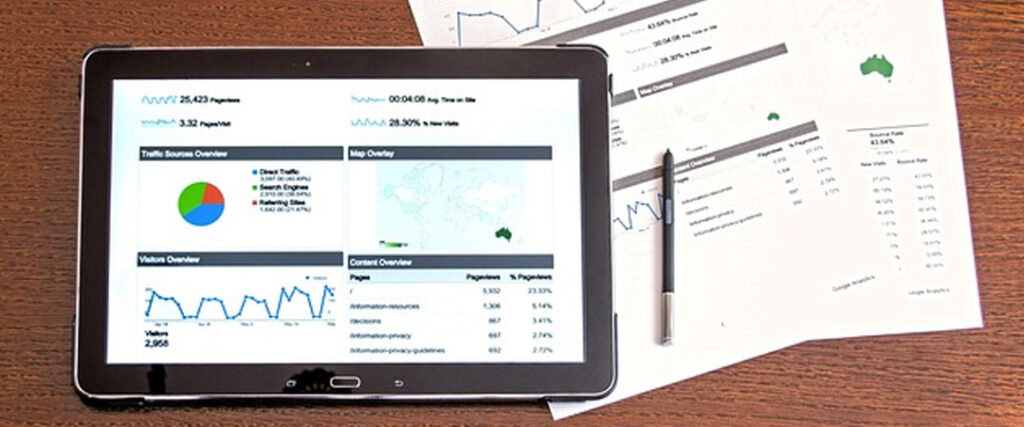

Using Annuity Payment Calculators

Annuity payment calculators are valuable tools that can assist in calculating the amount of money that will be paid out at regular intervals based on the initial investment and other factors.

These calculators can help you determine the length of time the fund can last based on a given payment amount, allowing you to make more informed decisions about which annuity product is right for you.

By inputting factors such as the initial investment, the annuitant’s age, and the expected interest rate, an annuity payment calculator can provide an estimate of monthly annuity payouts, enabling you to better plan for your retirement. You can always use a retirement income calculator to dome important estimations.

Monthly Annuity Payments Based on Investment Amounts

Did you know that the amount you initially invested in an annuity plays a significant role in determining your monthly annuity payments? Depending on your financial goals and the amount of income you require during retirement, you may choose to invest varying amounts, such as $100,000, $250,000, or $500,000. Each of these investment amounts will result in different monthly payments, influenced by factors like age and interest rates.

For example, if you invest $100,000 at age 65, you may receive a monthly payment.

$100,000 Annuity

A $100,000 annuity can provide a range of monthly payments depending on factors like age and interest rates. For example, a $100,000 annuity with a lifetime income rider may pay a monthly income ranging from $448 to $1,524, depending on the age at which the annuity is acquired and the period before withdrawing the funds.

It is crucial to consider these factors when selecting an annuity to ensure that it meets your needs and provides the desired level of income.

$250,000 Annuity

A $250,000 annuity can offer higher monthly payments, with the exact amount determined by factors such as age and interest rates. For example, a $250,000 annuity with a lifetime income rider is estimated to pay between $1,120 and $3,415 per month.

By considering these factors when selecting an annuity, you can ensure that it meets your needs and provides the desired level of income during your retirement years.

$500,000 Annuity

A $500,000 annuity can yield even higher monthly payments, with the specific amount influenced by factors like age and current interest rates. For instance, a $500,000 annuity with a lifetime income rider would pay between $2,542 and $6,831 monthly, depending on the age at which you purchase the annuity contract and the time before taking the funds.

By considering these factors when selecting an annuity, you can ensure that it meets your needs and provides the desired level of income during your retirement years.

Maximizing Annuity Payouts

To make the most of your annuity investment, it’s essential to maximize the payouts you receive during retirement. There are several strategies for achieving this, including delaying your payouts and choosing the right payout options.

By implementing these strategies, you can ensure that you receive the highest possible income from your annuity.

Delaying Payouts

There’s another strategy to increase annuity payouts, which is delaying them. Delaying annuity payouts can result in higher monthly payments due to the accumulation of interest and a shorter payout period. By allowing your annuity to accumulate more interest over time, you can potentially increase your overall income during retirement.

However, there are potential drawbacks to delaying payouts, such as the risk that you may not live long enough to receive the full value of the annuity or the inability to access the money in the event of an urgent situation. It is essential to weigh the benefits and risks of delaying payouts when selecting an annuity.

Choosing Payout Options

Choosing the appropriate payout option, such as a joint-and-survivor or period-certain annuity, can help maximize the income received from an annuity.

Factors to consider when selecting a payout option include your age, financial objectives, and risk tolerance, as well as the tax implications of the chosen annuity payout option.

By carefully evaluating these factors and selecting the right payout option, you can ensure that you receive the maximum possible income from your annuity investment.

Risks and Considerations

Investing in annuities comes with certain risks and considerations that should be taken into account. These include fees and expenses associated with the annuity, the impact of inflation on purchasing power, and market conditions affecting interest rates.

By understanding these risks and making informed decisions, you can minimize potential pitfalls and optimize your annuity investment for a secure retirement.

Fees and Expenses

Annuities can come with various fees and expenses, such as surrender charges and management fees, which can impact the overall return on investment. These fees and expenses vary depending on the type of annuity and the specific contract terms.

It is essential to be aware of all associated costs when selecting an annuity to ensure that you are making a sound financial decision.

Inflation and Purchasing Power

Inflation, often characterized by rising prices, can erode the purchasing power of annuity payments over time, making it essential to consider investments that can help offset inflationary effects. As the cost of living increases, the value of your annuity payments may not keep pace, resulting in a decrease in your overall purchasing power.

By incorporating inflation-protected investments into your portfolio, you can help beat inflation, safeguard your financial future, and maintain your standard of living during retirement.

Market Conditions and Interest Rates

Market conditions and interest rates can influence the performance of annuities, particularly variable and indexed annuities. Fluctuations in interest rates can impact the value of your annuity payments, making it crucial to monitor these factors when investing in annuities.

By staying informed about market conditions and adjusting your investment strategy accordingly, you can optimize the performance of your annuity and secure your financial future.

Full Summary

Annuities offer a powerful strategy for beating inflation and securing a stable income during retirement. By understanding the various types of annuities, how they work, and the factors that influence their performance, you can make informed decisions that will optimize your retirement income.

By maximizing annuity payouts through strategies such as delaying payouts and choosing the right payout options, you can ensure a comfortable retirement and protect your financial future.

Now that you are equipped with the knowledge and tools to make informed decisions about annuities, it’s time to take control of your financial future. Invest in an annuity that meets your needs, and enjoy the peace of mind that comes with a secure and stable retirement income.

Introducing the Institute of Financial Wellness, committed to empowering individuals to reach their financial aspirations and embrace a life of abundance. Our comprehensive array of resources, services, and educational materials is designed to equip people with the tools they need to effectively plan for retirement, navigate financial matters, and attain lasting financial triumph.

Discover the endless possibilities that lie ahead by receiving your very own FREE Personalized Retirement Roadmap. Take the first step towards realizing your financial dreams today!

Frequently Asked Questions

How much does a $250000 annuity pay per month?

For a $250,000 annuity purchased at age 60, the monthly payments are approximately $1,094.

At age 65, the payments would be around $1,198 per month and around $1,302 per month at age 70.

How much does a $1.5 million dollar annuity pay?

A $1.5 million annuity will provide a guaranteed income of $91,500 annually, starting immediately for the rest of the insured’s lifetime.

This works out to $29,624 per month for the rest of their life.

Do annuities pay out monthly?

Yes, annuities can be purchased and then paid out on a monthly basis for the rest of your life.

What is the primary purpose of an annuity?

The primary purpose of an annuity is to provide a guaranteed income stream during retirement, offering a stable financial base for long-term financial security.

How do I choose the right type of annuity for my needs?

When selecting an annuity, consider your age, financial goals, risk tolerance, and the potential effect of inflation on your investment. Make sure to take these factors into account in order to find the best annuity for your needs.

Research the different types of annuities available, such as fixed, variable, and indexed annuities. Consider the fees associated with each type of annuity and the potential returns. Also, look into the future.