“The key to retirement is to find joy in the little things, to live beneath your means, and to save for the future.” – Suze Orman

The stages of retirement are filled with change and opportunity. Knowing what to expect can help you embrace each phase with confidence and ease, as well as obtain peace of mind from knowing your retirement score. Let’s get rid of all the fluff and discuss the five stages of a happy retirement marked by the fun lifestyle you deserve.

Start building your retirement roadmap today with the Institute of Financial Wellness!

Key Takeaways

- Retirement is a complex journey with five emotional and practical stages: initial euphoria, the wake-up call, reflection and adjustment, crafting a happy retirement, and redefining purpose post-career.

- Crafting a happy retirement includes establishing a daily routine, staying physically and socially active, managing finances carefully, and possibly engaging in part-time work or volunteer activities to find satisfaction and purpose.

- Health and mental wellness play crucial roles in retirement, emphasizing the need for regular physical activity, preventive health measures, and seeking support for mental health issues to maintain a positive and fulfilling retirement life.

Understanding the Retirement Journey: Embracing the Five Phases

Embarking on retirement is akin to traversing the five stages of a significant life transformation. This major transition extends well beyond leaving one’s professional duties behind. It encompasses personal growth, identity evolution, and discovering joy within an entirely new phase of existence. Throughout this metamorphosis into retirement life, retirees often encounter a spectrum of conflicting emotions as they grapple with their evolving sense of self, economic concerns, and social dynamics. Grasping these phases enables individuals to smoothly manage this shift toward a fulfilling retirement.

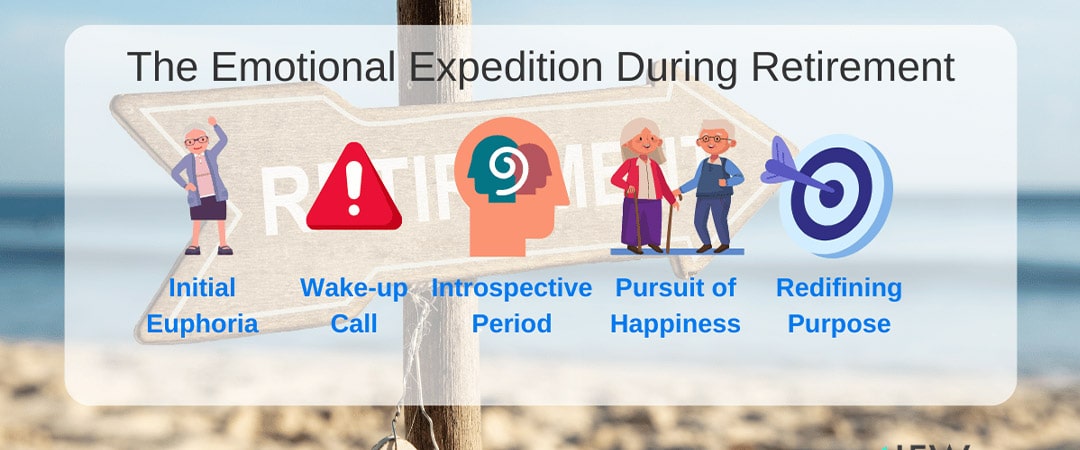

The quintet framework for understanding the emotional expedition during retirement includes:

- The initial euphoria stage with feelings resembling those experienced during an extended vacation.

- A wake-up call where previous exhilaration wanes and emotional hurdles surface.

- An introspective period dedicated to acclimating oneself to newfound daily routines.

- Deliberate actions in pursuit of happiness through engaging pastimes or interests in crafting a happy retirement phase.

- Lastly comes redefining purpose post-career, wherein there’s exploration for renewed significance beyond professional achievements.

Recognizing these distinct periods offers insight into the transformative process that underpins retiring from work.

- Anticipatory preparation preceding actual departure—pre-retirement planning,

- Entering uncharted territory following formal cessation—transition and adjustment,

- Introspection along with recalibrating personal objectives—reflection and adjustment,

- Active cultivation of contentment by fostering enjoyable pursuits—the essence lies in crafting a happy retreat from work-life obligations,

- And lastly, seeking out novel driving forces once career roles have been shed, redefining purpose post-professional era.

Initial Euphoria: The Honeymoon Phase

The honeymoon phase of retirement is a period filled with delight and a sense of freedom, similar to an everlasting vacation. During this stage, many retirees relish refreshing their lives with various activities, including:

- Embarking on travels both near and distant

- Spending quality time with grandchildren

- Seeking out warmer climates during colder months

- Taking excursions to museums, botanical gardens, or nature trails

Such pursuits imbue their golden years with enthusiasm and a fresh zest for life, giving them the illusion that these times will continue indefinitely.

Yet, as all good things eventually come to an end, so does this initial excitement linked to retirement’s honeymoon phase. Within one or two years, common experiences wane. The lure of adventure-packed travels and uninterrupted leisure gives way as its freshness diminishes. This adjustment period serves as an eye-opener for many individuals who face what it means to be retired without the foundational support of daily routines.

The Wake-Up Call: Encountering Reality

In the second stage of retirement, often referred to as the wake-up call, retirees begin to grapple with their new life circumstances. As the excitement from the initial honeymoon phase dwindles, they may experience a range of emotions, including disappointment and disillusionment, when reality doesn’t align with expectations. What once seemed like an endless vacation now demands adaptation to a new routine—a stark reminder that this is indeed a shift into another chapter of life.

This transition can be demanding as it signifies not only changes in social circles and financial dynamics but also necessitates significant alterations in one’s daily schedule—all factors that influence mental well-being significantly. Individuals must cope with losing aspects of their pre-retirement identity anchored by professional commitments that previously gave structure to their existence.

Despite potential setbacks during this adjustment period following retirement’s early blissful days, such realizations represent opportunities for growth and reinvention.

- Acknowledging what life will realistically look like post-career

- Strategizing for forthcoming years

- Pursuing newfound interests or roles beyond those defined by work

- Developing strategies resilient enough to embrace this latest chapter’s shifts successfully

Reflection and Adjustment: Finding Balance

Upon entering retirement, individuals embark on a phase of introspection and recalibration aimed at harmonizing their existence within this fresh chapter. This juncture is typified by:

- Adapting to the new dynamics retirement brings

- Adopting a grounded perspective

- Pondering over prior stages’ sentiments and episodes

- Revising expectations and prospective schemes

In navigating through this period of transformation, retirees may grapple with perplexity and aimlessness as they strive to carve out novel patterns in daily living. It’s essential that flexibility be welcomed during these times, permitting exploration into varied pursuits for time utilization towards achieving equilibrium in one’s post-career life. Venturing into uncharted hobbies, modifying personal habits, or pursuing communal interaction can infuse vitality and invigorate one’s approach.

The quest for equanimity in retiree life does not follow a universal blueprint. Rather, it unfolds as an explorative process laden with hit-and-miss experiences — all purposed toward sculpting an enriching, contented lifestyle emblematic of purposeful fulfillment. Through persistent realignment, reflective processes engaged by those retired pave the avenue leading them toward rewarding golden years filled with joyous gratification.

Crafting a Happy Retirement: Practical Strategies

Apart from reflection and adjustment, crafting a happy retirement involves implementing practical strategies. This includes establishing routines, managing finances, and nurturing relationships. Retirement is not just about leaving the world of work behind; it’s about creating a fulfilling and meaningful life that brings joy and satisfaction.

To reduce the risk of depression in retirement, it is crucial to:

- Stay physically active

- Have a balanced diet

- Get sufficient sleep

- Engage in enjoyable activities

In addition, engaging in mindfulness and meditation can alleviate stress, anxiety, and depression, enhance memory and attention, and benefit mental health [1]. Structuring days with small goals, growing friendships, and considering part-time work can also help retirees adapt and thrive in their new lifestyle.

Designing Your Day-to-Day: Establishing a Routine

Creating a structured daily routine is vital for enjoying a fulfilling retirement. A consistent schedule helps to:

- Ward off feelings of isolation, ennui, and depression

- Cultivate a sense of purposefulness

- Promote overall mental and physical health

- Diminish stress levels

- Enhance life contentment

Those retirees who stick to regular habits typically face less tension and report higher happiness levels in their retirement years [2].

Adhering to routines during retirement can instill meaning into individuals’ lives by setting personal objectives, taking up new hobbies, or offering their time for community service. Starting with modest ambitions allows room for growth, periodic reevaluation, and tweaking. It’s crucial that these activities are enjoyable and fulfilling, infusing each day with significance.

Venturing into varying schedules may keep retirees feeling invigorated while keeping boredom at bay. A weekly exploration of novel pursuits ensures freshness in one’s lifestyle. The most satisfied among them usually regularly indulge in three or four key pastimes. Some leisure activities which could be considered are:

- Tending gardens

- Artistic endeavors such as painting

- Engaging in board games

- Participating actively within local volunteer groups

Thus, securing a satisfying everyday routine is indispensable to experiencing joyous golden years post-retirement.

Financial Fine-Tuning on a Fixed Income

Achieving a joyful retirement hinges on financial stability, particularly when navigating the limitations of a fixed income. It is imperative for retirees to judiciously oversee their funds so as to maintain a comfortable lifestyle that encompasses their desired pursuits and pastimes. Crafting an all-encompassing budget becomes critical in effectively handling outlays pertaining to housing, healthcare, and recreational activities.

To maintain monetary equilibrium during retirement, it’s advisable for retirees to implement certain measures.

- Follow the ‘4 percent rule’ regarding withdrawal rates

- Apply either the ‘Rule of 100’ or ‘Rule of 120’ for maintaining an optimal stock-bond mix within portfolios

- Strategize tax-efficient withdrawal practices from various types of accounts

By integrating these approaches, those retired can better leverage their nest egg and investment proceeds, thereby ensuring they revel in their later years free from fiscal woes.

The intersection between financial security post-retirement and overall psychological and physical wellness is undeniable. With a meticulously arranged budget at hand, individuals transitioning into this new life phase can evaluate if there’s a need to engage in part-time work with aims like funding nonessential yet enjoyable undertakings such as getaways or meals shared with loved ones. Diligent preparation coupled with adept financial governance tactics amidst retirement planning ensures money concerns do not overshadow this chapter devoted predominantly to relaxation & family time.

The Power of Social Bonds: Nurturing Relationships

Cultivating relationships is a fundamental component of achieving a fulfilling retirement. It’s essential for retirees to keep their social connections alive as they can significantly impact mental health, overall well-being, and cognitive capabilities. The threat of isolation during the twilight years is real but can be lessened through strengthening friendships and staying socially engaged [3]. Such robust relationships are often associated with increased longevity and enhanced quality of life.

In terms of enhancing one’s retirement experience, social engagement serves several purposes:

- Lowering levels of stress and anxiety

- Offering support networks that provide connection

- Triggering the release of endorphins, which foster a positive outlook

- Making substantial contributions to one’s mental health, overall well-being, and sharpness in cognitive abilities

Retirees create opportunities to forge new bonds while keeping up existing ones by participating in community initiatives—like clubs or classes—and undertaking volunteer work- to ensure active social involvement.

Retirees who focus on relationship-building tend to enjoy more rewarding golden years surrounded by supportive friends within their communities. This contributes positively toward improving both mental resilience and emotional health. With this perspective at heart when entering into retirement life, it should become an integral part of your approach towards crafting an optimistic post-career phase filled with joyous experiences.

Empowering Retirement Financial Management: The Institute of Financial Wellness

During their retirement, individuals often require assistance and guidance to manage their financial resources effectively. The Institute of Financial Wellness provides an array of services that include:

- A robust multimedia network filled with educational materials, tools, and services dedicated to finance

- Dynamic and unbiased content aimed at educating on financial matters

- Tools designed to provide clarity and bolster the confidence necessary for making savvy financial decisions

Through these offerings, we equip people with what they need as they progress through their retirement.

With its distinctive value propositions, the Institute of Financial Wellness ensures tailored solutions are fully implemented according to each individual’s specific requirements. It also provides continuous advice and backing so clients can achieve optimal monetary success throughout every phase of life. Boasting over 35 highly esteemed certifications in financial services confirms the expertise our professionals hold.

A suite of options is available from the institute, like the IFW Retirement Roadmap, which allows families and persons approaching retirement age not only to aim for but also actualize grand visions for this stage without fear that finances will deplete or concerns about how stock market volatility might impact assets set aside for later years, including ways in which taxation could diminish those funds unnecessarily. With support from experts at the Institute for Financial Wellness, retirees find themselves well-equipped when confronting economic aspects tied to retired living, ensuring tranquility in one’s golden years.

Full Summary

Retirement is more than just a phase; it’s a journey through different stages, each with its own set of challenges and opportunities. From the initial euphoria of the honeymoon phase to the reality check of the wake-up call, the reflection and adjustment phase to crafting a happy retirement and redefining purpose post-career, retirees navigate through a labyrinth of emotions and experiences. With the right strategies and support, retirees can craft a fulfilling and satisfying retirement life full of joy, satisfaction, and purpose.

Retirement is a journey of self-discovery and growth, an expedition into new territories of life. It’s about redefining purpose, nurturing relationships, maintaining health and happiness, and finding enjoyment in the golden years. With a positive outlook and the right support, retirees can navigate the challenges and changes of retirement with grace and resilience, leading to a fulfilling and satisfying retirement life.

Frequently Asked Questions

What are the 4 steps of retirement?

Each of the four stages of retirement—Transition, Active, Passive, and Final—possesses distinct traits and priorities. These range from reducing work commitments to a journey of self-discovery, enjoying increased liberty in life’s later years, to reaching a state of satisfaction.

How can I find balance in retirement?

In order to achieve equilibrium during retirement, it is beneficial to explore a variety of pursuits, set up a consistent schedule, and pursue companionship and encouragement from both friends and family members. By taking these measures, you can cultivate an enriching lifestyle encompassing all aspects of your retirement years.

Why is establishing a routine important in retirement?

Creating a consistent schedule during retirement is crucial as it helps relieve feelings of emptiness, isolation, and depression by nurturing a sense of meaning.

How can I maintain my health in retirement?

To ensure a healthy retirement, it’s vital to concentrate on maintaining physical activity, consuming a nutritious diet, ensuring adequate sleep, participating in activities that bring joy, and obtaining assistance for any mental health issues.

By giving priority to these elements, you can achieve a satisfying and wholesome retirement experience.