“It’s never too early to start saving, but it can be too late.” – Unknown

What exactly do the wealthy impart to their children that gear them toward financial triumph? The secret lies in ‘what the rich teach their kids’—not just about money, but about life. In the preamble of Teach Your Children to Save Day, let’s strip down the complex veil of affluent child-rearing, offering you a direct line to the strategic thinking and smart habits that pave a child’s way to fiscal competence and confidence. Prepare to absorb these critical lessons that could very well reshape your approach to teaching financial readiness at any income level and at any stage in your life.

Part of that financial readiness is preparation for the future. Learn your retirement score today and start planning for retirement ahead.

Key Takeaways

- Teaching children financial literacy early on, using tools like apps, piggy banks, and family discussions, is crucial for developing responsible financial behaviors and differentiating between wants and needs. Teach Your Children to Save Day presents itself as a great opportunity for this.

- Introducing kids to saving and investing, emphasizing the relationship between risk and reward, and encouraging entrepreneurial thinking prepare them for long-term wealth creation and financial independence.

- Fostering financial independence in youth through work, developing good credit habits, and planning for the future complements the teaching of philanthropy, ensuring they grow into financially savvy and socially responsible adults.

The Early Lessons: Building a Strong Financial Foundation

Instilling robust financial habits from a tender age is crucial, as studies show these patterns are established by the time children reach seven. Teaching youngsters about earning, saving, and spending money is pivotal for them to evolve into adults who manage their finances responsibly [1].

Leveraging cutting-edge applications such as BusyKid and Greenlight helps acquaint kids with the digital aspects of contemporary finance. Meanwhile, tangible instruments like piggy banks combined with familial conversations and help from financial advisors like The Institute of Financial Wellness regarding fiscal matters help cultivate the essentials of financial planning and self-reliance.

Money Values and Priorities

Navigating the complexities of personal finance requires children to comprehend the significance of their own money, distinguishing what they desire from what is necessary. This crucial knowledge equips them with the ability to spend money wisely and foster a sense of responsibility towards finances.

Incorporating children into buying decisions by having them pitch in for items like toys can teach them about the purchasing power of money. It helps instill early financial decision-making skills and introduces strategies on how to save money effectively.

Saving Habits

Teaching children the principle of saving money is fundamental to their financial education. It provides them with a foundation for long-term economic stability and underscores the significance of allocating a specific sum towards achieving savings objectives, thereby aiding in their ability to save funds.

By sharing engaging narratives such as ‘Rock, Brock, and the Savings Shock’ and familiarizing kids with the concept of savings accounts, they discover how compound interest works wonders on their finances and experience the delight that comes from observing their money multiply.

Budgeting Basics

Effective financial planning and the art of managing money prudently are skills best imparted through hands-on experience. Teaching children to distribute their monthly allowance into distinct categories—savings, expenditure, and donations—instills a foundational understanding of fund distribution for various objectives such as household costs and philanthropic contributions.

Initiating these fundamental teachings in financial management sets the groundwork for young individuals to excel in making spending choices that resonate with their long-term economic aspirations [2].

Investing Knowledge: Preparing Kids for Long-Term Wealth Creation

It is vital for children’s future financial success to familiarize them with investing as they mature. Educating kids on various investment options and the correlation between risk and potential gains equips them with the knowledge necessary for wise economic choices.

Allowing children to handle a simulated stock portfolio helps make the subject of the stock market more captivating by teaching them about putting their money into recognizable brands like Nike or Apple. This hands-on approach enhances their understanding of how investments work in companies that are part of their everyday world.

Understanding Investment Vehicles

Vehicles for investment, like stocks and bonds, constitute the fundamental components of a varied portfolio. It’s important for children to grasp that though stocks hold the potential for substantial gains, they carry increased risk as market volatility can impact their value significantly. Alternatively, bonds represent steadier investments with typically modest yields, presenting a more secure choice for those who prefer minimal risk.

Teaching these concepts lays down an essential base comprehension regarding financial risk in relation to return rates.

Teaching Risk and Reward

Comprehending the balance between potential gains and associated risks is fundamental in the realm of investments. Events like the GameStop trading surge offer children tangible examples to understand investment volatility. Visual aids, such as the ‘Tips for Teens’ risk pyramid, can effectively demonstrate how different financial products carry varying degrees of risk, underpinning the concept that with greater prospects for return typically comes a higher level of danger.

Encouraging Entrepreneurship

Encouraging entrepreneurial spirit within children can enhance their ability to:

- Invent novel ideas

- Identify potential ventures

- Participate in conversations about family businesses

- Undertake initiatives such as setting up a lemonade stand

Such activities ignite a curiosity for earning money while imparting crucial knowledge on investment and managing finances.

When children are given access to either a custody account or an artificial portfolio, they acquire hands-on experience in the realm of financial decision making. This foundational practice is key to achieving financial independence in the future.

Financial Independence: Fostering Self-Sufficiency and Responsibility

To attain financial success and independence, it’s crucial for children to grasp the connection between hard work and monetary gain. Instilling a strong work ethic and fostering responsibility by teaching children how to earn money through tasks or part-time jobs lays the groundwork for them to become financially responsible adults. By doing so, kids learn about the significance of money as well as the necessity of saving in preparation for upcoming costs.

Earning Money Through Work

Understanding the principle that money must be earned rather than simply handed out is crucial for children to understand the relationship between labor and financial reward. When children receive monetary rewards for accomplishing specific tasks, they learn to value money more and start taking responsibility for their own finances.

Encouraging them to take on part-time work or engage in modest entrepreneurial endeavors not only furnishes them with funds, but also imparts important lessons in managing their finances effectively.

Developing Good Credit Habits

Building good credit is an integral part of financial success. Educating children on the proper use of credit cards can prevent future financial pitfalls. Here are some key points to discuss with your children:

- The impact of interest and the importance of timely payments

- The benefits of paying off balances monthly

- The potential consequences of carrying a high credit card balance

- The importance of budgeting and only charging what can be paid off

- The potential risks of overspending and accumulating debt

Parents play a key role in modeling responsible credit behavior and should discuss credit card usage with their children.

Planning for the Future

Financial planning plays a pivotal role in achieving financial independence, incorporating elements like creating budgets and allocating funds for future objectives. By engaging children in the process of making financial choices and promoting their involvement in saving towards substantial acquisitions, we can teach them the value of foresight when it comes to finances.

Instruments such as the ‘Living Wage Calculator’ are beneficial in educating children about living expenses and underscoring the essential nature of strategic financial preparation.

The Power of Giving: Instilling Philanthropy and Social Responsibility

Teaching children about the importance of giving, both in monetary donations and volunteer work, cultivates their understanding of philanthropy and social responsibility. This education ensures they mature into financially prudent individuals who are also empathetic citizens with a global perspective, aware of their significant influence over their surroundings.

Charitable Giving

Instilling empathy and compassion in children can be achieved through lessons in charitable giving. When children participate in community service, it fosters the development of positive attributes within them and enhances their sense of self-worth.

Educating children on making tax-deductible donations motivates them with financial benefits and guarantees that their gifts make a meaningful difference.

Volunteering and Community Involvement

Encouraging children to engage in volunteer work is an effective method for them to establish connections within and make valuable contributions to their community. This involvement strengthens social ties and nurtures a feeling of active participation and ownership in societal affairs.

When young people are urged to take on roles as volunteers, they infuse organizations with new vitality while cultivating feelings of empathy and mutual respect.

Integrating Philanthropy into Financial Plans

Educating children on how to blend personal wealth management with social responsibility by including philanthropy in their financial strategies is crucial. By employing tax-effective methods like contributing appreciated assets or utilizing a donor-advised fund, they can enhance the effectiveness of their charitable contributions and simultaneously obtain financial advantages for themselves [3].

Educational Resources and Practical Applications

There is an abundance of educational materials and hands-on applications that make learning about finance interesting and easy for kids to grasp. Among these tools are:

- Literature

- Web-based training programs

- Games with interactive features

- Applications for smartphones

These instruments provide innovative methods to impart crucial financial concepts to children.

Books and Online Resources

Numerous kid’s money books suitable for different ages and digital tools are available to impart the principles of personal finance and investing to children. These resources employ engaging narratives and interactive activities to establish a robust base in financial literacy.

Hands-on Learning Experiences

Engaging children in practical learning activities such as playing board games or participating in investment simulations can enhance the effectiveness and enjoyment of financial education. Experiencing actual financial situations through opening a personal bank account or simulating an economy within their own home helps to solidify their grasp on managing money. Delving into the functions of key institutions like the Federal Reserve Bank gives these educational experiences important real-world relevance.

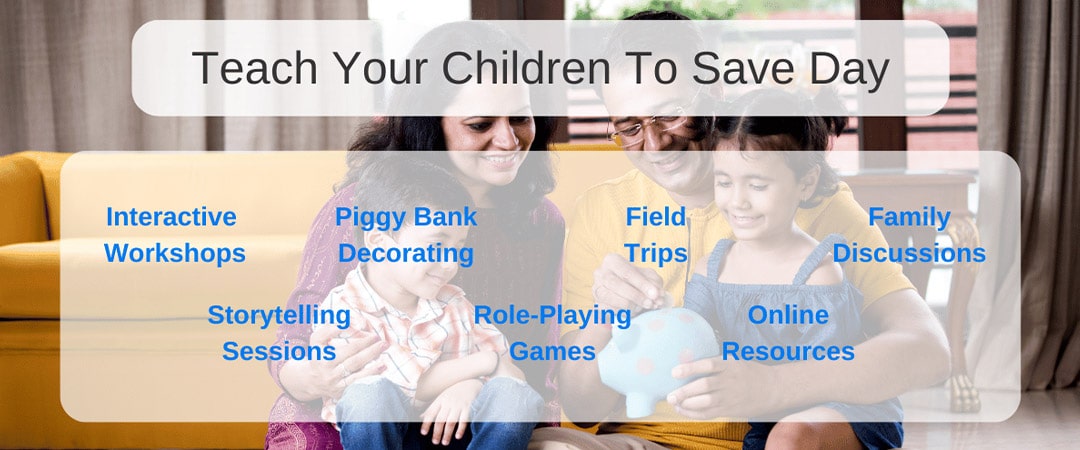

Empowering Futures: Teach Your Children to Save Day

“Teach Your Children to Save Day” is an annual event celebrated to promote financial literacy and encourage children to develop healthy saving habits from an early age. This day, observed on April 20th in many countries, reminds parents, educators, and communities about the importance of teaching children the value of money management.

Financial education is a critical life skill that lays the foundation for a secure future. By instilling good saving habits in children, we empower them to make informed decisions about money, budgeting, and planning for their financial goals.

On Teach Your Children to Save Day, parents and educators can engage in various activities to educate children about saving money:

1. Interactive Workshops: Schools, libraries, and community centers often organize workshops tailored to different age groups. These workshops may include interactive games, discussions, and activities to teach children about the concepts of saving, budgeting, and setting financial goals.

2. Storytelling Sessions: Storytelling is a powerful tool for teaching complex concepts in a simple and engaging way. Parents and teachers can read age-appropriate books emphasizing the value of saving money and making wise financial choices.

3. Piggy Bank Decorating: Encourage children to personalize their piggy banks and start saving loose change. Decorating piggy banks makes saving fun and fosters a sense of ownership and responsibility.

4. Role-Playing Games: Role-playing games allow children to simulate real-life financial scenarios, such as earning an allowance, budgeting for expenses, and saving for a goal. Through these games, children learn practical money management skills in a safe and supportive environment.

5. Field Trips: Visits to banks or financial institutions can provide children with firsthand experience of managing and saving money. Many banks offer educational programs designed specifically for young savers, introducing them to basic banking concepts and services.

6. Online Resources: In today’s digital age, there are numerous online resources, websites, and apps dedicated to teaching children about money management. Parents and educators can leverage these resources to supplement traditional learning methods and make financial education more accessible and engaging.

7. Family Discussions: Regular family discussions about money help demystify financial matters and encourage open communication about saving, spending, and budgeting. Parents can empower children to become financially responsible individuals by involving them in age-appropriate financial decisions.

Teach Your Children to Save Day is about one day of awareness and fostering a culture of financial responsibility that lasts a lifetime. By equipping children with the knowledge and skills to manage their finances effectively, we empower them to build a brighter and more secure future for themselves.

Empowering Financial Success at Any Stage in Life: The Institute of Financial Wellness

At the vanguard of financial education, The Institute of Financial Wellness provides a broad selection of resources and services designed to facilitate individuals’ financial success. Dedicated to delivering captivating and impartial material, the IFW guarantees access to essential knowledge for an optimal life experience across all economic backgrounds. Contact a financial advisor from our team today!

Full Summary

We’ve delved into the crucial teachings and techniques that those with wealth impart to their offspring on the art of managing money. The spectrum of financial literacy extends from fundamental concepts such as saving and budgeting to more complex matters like investing and charitable giving. Embedding these values from a young age sets up individuals for enduring fiscal success and conscientious participation in society. Now is the moment to equip our children with this knowledge so they can attain financial independence and contribute constructively to the global community.

Frequently Asked Questions

What books do rich parents teach their children?

Parents with wealth frequently instill the tenets of Robert Kiyosaki’s “Rich Dad, Poor Dad” in their children, underscoring the importance of financial education and wealth accumulation.

What is lesson 8 of Rich Dad Poor Dad?

Rich Dad, Poor Dad’s eighth lesson underscores the importance of acquiring financial literacy, recognizing opportunities, and embracing risk-taking. It motivates individuals to question conventional money-related perceptions and strive for economic self-reliance.

What do the rich teach their children?

Wealthy individuals impart to their offspring the significance of industriousness, postponed pleasure in financial choices, and the strength that comes from passive income streams and savvy investments, which enable money to generate more wealth. This guidance is crucial in aiding their children in grasping the essentials of enduring financial planning and intelligent investment techniques.

At what age should financial education for children begin?

It is essential to initiate financial education in children from a young age, approximately around the age of seven, in order to cultivate healthy financial behaviors.