The idea that ‘you need money to make money’ rings true in many situations. But when it comes to saving for retirement, the beauty is that even a small amount of money invested early can turn into a substantial nest egg over time. Sometimes, the simplest tools can make the biggest difference. Enter the Rule of 72 — an easy, time-tested way to estimate how long it will take for your investments to double.

Let’s dive in and break it all down in a friendly, no-nonsense way so you can put this powerful tool to work for your retirement goals.

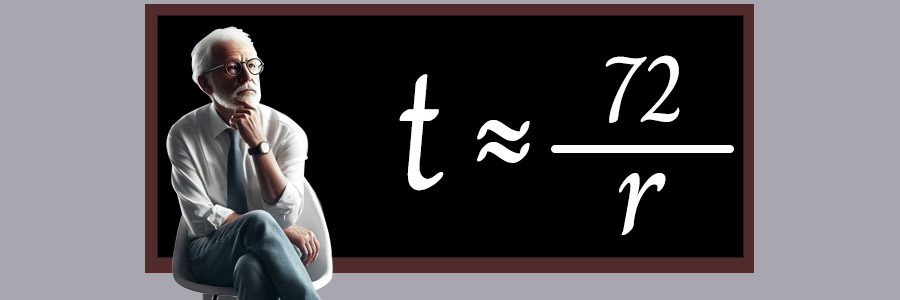

What Is the Rule of 72?

The Rule of 72 is a quick and simple formula to estimate how many years it will take for your investment to double, based on a fixed annual rate of return. Here’s how it works:

72 ÷ Annual Rate of Return (%) = Years to Double Your Money

That’s it! No calculators, spreadsheets, or complex math needed. Let’s look at a couple of examples:

- If you expect an annual return of 6% on your investments, the Rule of 72 says it will take 12 years for it to double (72 ÷ 6 = 12).

- If your expected annual return is 10%, then the Rule of 72 says it will take just over 7 years to double your money (72 ÷ 10 = 7.2).

This works thanks to the power of compounding returns over time — your money earns money, and those earnings start earning money too. The Rule of 72 helps you understand how quickly that compounding can grow your savings.

Why Is the Rule of 72 So Helpful for Retirement Planning?

When you’re planning for retirement, knowing how long it will take for your money to grow can make all the difference. Here’s why the Rule of 72 is such a handy tool:

- It’s Simple and Quick – No need for fancy formulas or software. With just one quick calculation, you can see the potential growth of your investments.

- It Helps You Set Realistic Goals – If you’re 15 years from retirement and want to double your money, the Rule of 72 can help you evaluate if your current investment strategy will get you there in time. It’s one of the simplest ways to prepare for retirement with clear, actionable insights.

- It Highlights the Power of Compounding – Seeing how your money can grow over time is a great motivator to stay invested and let compounding do its thing.

- It Balances Risk and Reward – Higher returns mean your money grows faster, but they often come with higher risks. The Rule of 72 helps you weigh whether an investment’s potential reward matches your comfort with risk.

How to Use the Rule of 72 for Retirement Planning

The Rule of 72 isn’t just about math — it’s about making smarter decisions with your money. Here are a few ways to put it to use:

- Evaluate Investment Options – Let’s say you have $50,000 to invest, and you’re considering two options:

- A safe, steady investment with a 4% annual return will double your money in 18 years (72 ÷ 4 = 18).

- A portfolio with a 10% return, like a mix of stocks and ETFs, will double your money in just over 7 years (72 ÷ 10 = 7.2).

If you’re 20 years from retirement, the safer option might make sense. But if you’re 5-10 years out, the higher return (and higher risk) option could help you hit your goals faster.

- Plan Around Your Timeline – If you’re closer to retirement, you’ll likely want to prioritize stability over high returns. The Rule of 72 helps you gauge whether an investment will grow enough within your timeframe.

- Stay Motivated to Save and Invest – Seeing how your money can double over time can inspire you to save more and stick with your plan. The earlier you start, the more doubling cycles you can take advantage of.

Key Considerations When Using the Rule of 72

While the Rule of 72 is incredibly useful, it’s not a perfect science. Here are a few caveats to remember:

- It’s an Estimate — Real-world returns can fluctuate, so your actual timeline might vary. That’s why diversification and regular portfolio reviews are key.

- Taxes and Fees Matter — The Rule of 72 doesn’t account for taxes, fees, or inflation, which can all impact your returns.

- Reinvesting Is Crucial — For compounding to work, you need to reinvest your earnings. If you withdraw returns, your growth will slow down.

- Balance Risk and Return — Higher returns often come with higher risks. Ensure your portfolio reflects your risk tolerance and time horizon, especially as you approach retirement.

Applying the Rule of 72: Real-Life Scenarios

Let’s look at how different people might use the Rule of 72 in their retirement planning:

- Scenario 1: The Conservative Saver

Pat is 10 years from retirement and prefers low-risk investments like bonds, which average a 4% annual return. Using the Rule of 72, Pat knows their money will double in 18 years (72 ÷ 4 = 18). While doubling may take longer than their timeline, Pat feels confident about the safety of their investment. - Scenario 2: The Growth-Oriented Planner

Jamie is 15 years away from retirement and opts for a portfolio with an 8% return, a mix of stocks and mutual funds. Jamie’s money will double in 9 years (72 ÷ 8 = 9), giving them a strong chance of meeting their financial goals on time. - Scenario 3: The Late Bloomer

Alex is just 5 years from retirement and realizes they need to boost their savings quickly. They consider higher-risk options like ETFs that could return 12% annually, doubling their money in just 6 years (72 ÷ 12 = 6). While riskier, this strategy aligns with Alex’s need for accelerated growth.

These examples highlight how to use the rule of 72 to guide your investment choices to grow your wealth responsibly and meet your retirement goals.

Take Charge of Your Retirement with the Rule of 72

Tools like the Rule of 72 help you focus on what really matters: growing your wealth and creating the retirement lifestyle you’ve always envisioned. By using this tool, you can:

- Evaluate investments based on your timeline and goals.

- Stay motivated to save and invest.

- Make smarter decisions about risk and reward.

Ready to take the next step? Consider working with a financial advisor who can help tailor your investment strategy and make sure your money works as hard as you do. The future is yours to plan!

See How You Can Boost Your IFW Retirement Score

When you request your IFW Retirement Score, an IFW Certified Financial Professional will help you discover ways to:

Lower or potentially eliminate taxes in retirement

Protect your retirement portfolio

Secure a stable income stream throughout retirement