“Money can’t buy happiness, but it can make life a lot easier when you become a millionaire.” – Unknown

Are you curious about ‘National Be a Millionaire Day’? It’s not just about having a million dollars—it’s about making smart financial choices to get there. On May 20th, discover how to build your wealth intelligently and assess whether a million is still the golden number for a comfortable future.

Schedule a 1-on-1 personal introduction and find out how you can retire comfortably with The IFW’s expert guidance’s through our Retirement Roadmap Services.

Key Takeaways

- National Be a Millionaire Day on May 20th promotes setting ambitious financial goals and celebrating wealth-building achievements.

- Building a million-dollar nest egg requires early and consistent savings, investment diversification, and nurturing additional income streams.

- Maximizing retirement savings involves leveraging tax-advantaged accounts and understanding Social Security benefits while also prioritizing financial education and preparedness for the unexpected.

Understanding National Be a Millionaire Day

Dating back to the late 1990s, National Be a Millionaire Day serves as an emblem of wealth, aspiration, and triumph. Circle May 20th on your calendar. This day transcends ordinary expectations—it’s an exhortation to establish monetary objectives and ceaselessly pursue dreams that transcend even the magnetism of possessing a million dollars.

This occasion is dedicated to honoring our driving ambitions. It acts as a yearly nudge reminding us both to construct strong bases for our sought-after riches and commemorate the progress we’ve made towards such financial milestones [1].

The Million Dollar Question: Is It Enough?

The pivotal question of whether a million dollars suffices for a comfortable retirement continues to stir debate. Adhering to the 4% rule, withdrawing from a million-dollar nest egg may provide an annual income close to $40,000 once adjusted for inflation. Considering that financial advisors often recommend retirees have around 80% of their pre-retirement earnings to sustain their accustomed lifestyle, this matter becomes more complex due to variables such as living costs, health conditions, and individual lifestyle desires.

In today’s terms, possessing a million dollars doesn’t hold the same weight it did in the past. With inflation anticipated to erode its value down effectively making what’s worth one million now akin up to about $1.8 million over two decades henceforth. When contemplating how taxes will affect retiree incomes upon withdrawal too—it becomes clear that having “enough money” for retirement is not only subjective, but also heavily dependent on personal situations and shifting economic climates.

Blueprint for Building Your Million-Dollar Nest Egg

Embarking on the path to accumulate a million dollars requires a well-crafted plan. Self-made individuals who have achieved this goal typically adopt tactics such as paying themselves first, taking full advantage of employer matching contributions for retirement accounts, and continuously improving their financial knowledge while making astute investments.

To construct a robust million-dollar portfolio that can withstand the test of time, it is critical to understand the importance of starting early, spreading your assets across diverse investment opportunities, and developing multiple streams of income.

Start Early and Save Consistently

Commencing your journey to financial independence and breaking free from the daily grind hinges on two principles: initiate savings at a young age and maintain steady contributions. By leveraging compound interest starting in your twenties, even modest recurring deposits can accumulate into substantial funds over several decades. The quest for retirement is less about the initial amount saved than it is about the timing of when you start investing. Challenges like repaying student debt or managing with an initially modest income can be overcome with a methodical saving strategy, setting a solid foundation for potentially retiring ahead of schedule [2].

Safeguarding the integrity of your retirement savings is crucial. Avoid the urge to dip into these funds prematurely so that you can capitalize fully on long-term investment gains’ potential.

Diversify Investments to Survive Bear Markets

In the journey to amassing a million-dollar portfolio, successfully traversing bear markets and the stock market’s inherent fluctuations is crucial. Achieving this milestone involves portfolio managers carefully calibrating a mixture of assets that include stocks, bonds, and cash—a strategy aimed at fostering both growth and income while also providing protection during times of market decline. The Institute of Financial Wellness offers expert financial advisors who can help you get to the millionaire status.

It’s essential to tailor your investment approach in line with your tolerance for risk and the remaining period until you retire. Doing so ensures that your savings are shielded from unexpected economic disturbances.

Maximize Income Streams

Possessing a portfolio valued at a million dollars can be greatly enhanced with supplementary sources of income, an approach commonly employed by individuals who have achieved financial autonomy. Engaging in side enterprises, various investments, and lucrative real estate projects such as leasing properties can substantially increase your earnings. Self-made millionaires are proof positive of this strategy. They expand their revenue streams to guarantee consistent cash flow that aids in the rapid expansion of their nest egg.

Hence, should you aspire to live the millionaire lifestyle, it is wise to seek avenues for additional income to place you on a path toward prosperity.

Leveraging Tax-Advantaged Accounts

In the quest to build up your retirement savings, utilizing Roth IRAs and 401(k)s can be incredibly effective due to their tax-advantaged status. These accounts enable you to grow your money by deferring taxes on investments, thereby allowing a larger portion of your income to compound over time. It’s important to understand that while traditional IRAs and 401(k) plans reduce your current taxable income, Roth IRA benefits come later, with withdrawals being tax-free in retirement.

By methodically boosting the amount you contribute towards these types of accounts—and taking full advantage of any employer match programs—you lay a robust foundation for an ample retirement account balance.

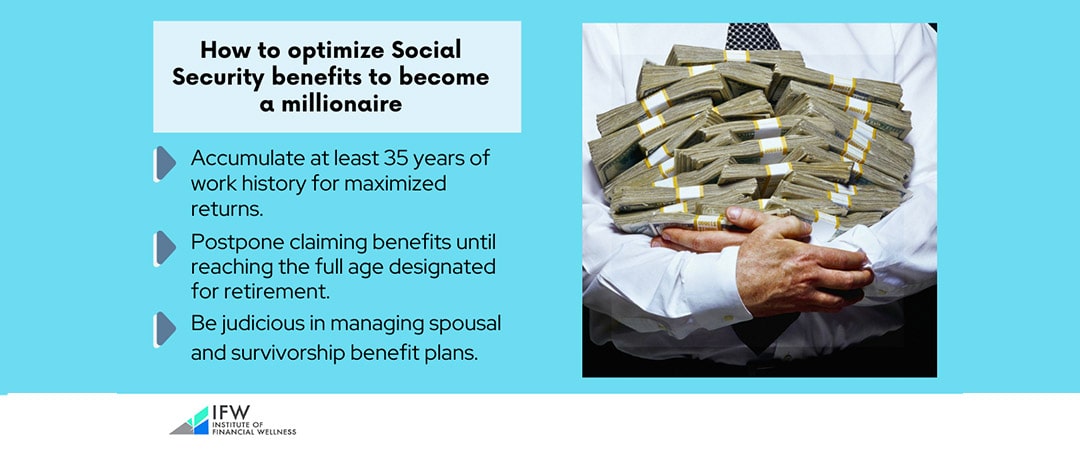

Social Security Benefits and Your Millionaire Goals

In the complex landscape of retirement preparation, social security benefits are a crucial element that enhances your overall income sources. These benefits should be woven into your retirement savings strategy as an additional source to help reach that desirable million-dollar mark. It’s important to grasp how to optimize Social Security disbursements effectively, and here are several tactics you might consider.

- Accumulate at least 35 years of work history for maximized returns.

- Postpone claiming benefits until reaching the full age designated for retirement.

- Be judicious in managing spousal and survivorship benefit plans.

Employing these methods can bolster your Social Security offerings and augment your nest egg for later life.

Keep in mind that eligible dependents younger than 19 may also qualify for certain payouts, which could boost the collective family’s income intended for use during retirement without reducing what you personally receive [3].

Lifestyle Choices That Affect Your Millionaire Status

Earning a million dollars is equally dependent on one’s spending habits as it is on their income. Those who have accumulated wealth through their own efforts typically demonstrate frugality, preferring enduring worth rather than short-lived opulence—a choice critical to maintaining a millionaire lifestyle. They avoid succumbing to extravagant expenditures and are careful in handling their finances, particularly steering clear of borrowing for assets that lose value.

These affluent individuals also ensure the longevity of their wealth by making smart choices like leveraging reward-yielding credit cards and transitioning to less risky investments when approaching retirement. This strategic financial management helps them preserve their status as millionaires while preparing for an enjoyable life after work ends.

Learning from Self-Made Millionaires

Gaining insights from individuals who have successfully accumulated a million-dollar portfolio can serve as an invaluable guide to achieving your own fiscal goals. Self-made millionaires emphasize the necessity of improving one’s financial literacy, recommending that aspiring wealth builders immerse themselves in educational materials to attain financial independence.

By embracing Shen’s mathematically validated strategies and adapting them to fit your unique journey, you are better equipped to tackle the pressing question everyone faces. How do I secure a comfortable retirement? This is indeed the “million-dollar” challenge many strive to resolve.

Preparing for the Unexpected: Insurance and Emergency Funds

Achieving financial independence isn’t just about amassing wealth. It’s also crucial to safeguard that wealth from unforeseen circumstances. As a buffer against unexpected costs, an emergency fund serves as your fiscal safety net, ready for use in times of need. Millionaires recognize the value in maintaining a reserve large enough to cover six to nine months’ worth of living expenses—this ensures tranquility and financial stability.

As retirement approaches, securing adequate healthcare insurance is essential to any sound financial strategy. Without proper anticipation and planning for such expenses—including potential fees from a medical doctor—healthcare costs could significantly deplete one’s savings during their golden years.

Celebrate by Evaluating Your Financial Health

National Be a Millionaire Day serves not only as a cause for jubilation but also as a moment for thoughtful self-examination. It’s an opportune moment to rigorously assess your financial situation, checking in on how well you’re tracking toward ensuring ease during retirement. Conducting this personal evaluation can highlight if it’s time to recalibrate your strategies or establish new fiscal objectives that match your aspirations for accruing wealth.

At times, the path to financial independence necessitates consulting with experts who can help devise a more calculated plan concerning your savings and investments geared toward retirement.

Institute of Financial Wellness: Your Path to Fiscal Success

Serving as a beacon for individuals pursuing financial transparency and assurance, the Institute of Financial Wellness (IFW) is your go-to source. A vast array of educational materials, resources, and expert services populate this multi-media platform to help you navigate towards your aspirations worth millions of dollars. Engaging in everything from e-newsletters to webinars enables access to some of the most captivating content and sagacious financial experts within the industry.

Join The Retirement Roadmap Webinar and start saving like a millionaire!

IFW stands ready with its all-inclusive offerings and dedicated finance specialists, whether your aim is enhancing your 401(k), reducing expenses related to higher education, or ensuring a solid foundation for your estate. We are committed to providing support at every juncture on your journey toward fiscal success. Calculate your Retirement Score and ask our financial advisors for guidance!

Full Summary

As we reach the culmination of our guide, it’s evident that becoming a millionaire is an attainable goal with the right mindset, tools, and strategies. From the foundational steps of saving early and diversifying investments to the nuanced decisions around tax-advantaged accounts and lifestyle choices, each element plays a pivotal role in your financial narrative. Embrace the lessons from self-made millionaires, prepare for the unexpected, and continuously evaluate your financial health. With resources like The Institute of Financial Wellness at your disposal, the path to financial independence is clearer than ever.

Frequently Asked Questions

Is it necessary to earn a high income to become a millionaire?

No, it’s not imperative to have a substantial income in order to accumulate wealth up to a million dollars. By regularly setting aside savings, making intelligent investment choices, and managing expenditures efficiently, one can achieve fiscal prosperity without relying on high earnings.

How do I choose the right investments for my retirement portfolio?

When selecting investments for your retirement fund, it’s important to evaluate how comfortable you are with risk and the amount of time before you retire. Strive to allocate your resources among a mixture of stocks, bonds, and cash, as this can help harmonize potential growth with effective risk control.

Can I still become a millionaire if I start saving later in life?

Indeed, it is beneficial to commence retirement savings as soon as possible. Embarking on this journey at a later stage is still feasible. To compensate for the delayed start, you may have to allocate a larger portion of your income toward savings and explore ways to generate additional income.

Thus, achieving millionaire status by the time of retirement can be within reach even for those who begin accumulating their nest egg down the road in life.

Are tax-advantaged accounts worth it if I’m not a high-earner?

Certainly, earners from all income brackets can benefit from tax-advantaged accounts such as Roth IRAs and 401(k)s. These vehicles permit retirement savings to accumulate either without incurring taxes or by deferring them, which, over time, can have a substantial effect on the growth of retirement income.

How much should I save in my emergency fund?

It’s advisable to accumulate an emergency fund that covers six to nine months’ worth of living expenses. Yet, the precise sum may vary based on individual circumstances and how stable your sources of income are.