Planning for long-term care (LTC) is a major financial challenge for retirees. According to the U.S. Department of Health and Human Services, nearly 70% of people over 65 will need some form of LTC, with women at even higher risk due to their longer life expectancy

With nursing home costs topping $100,000 a year and in-home care running thousands per month, these expenses can quickly drain retirement savings. Yet, many retirement plans focus on income and investments while overlooking the impact of long-term care costs.

This is where long-term care annuities come in—they help your savings grow while providing a built-in safety net for care expenses. Let’s explore how they work and why they might be a smart addition to your retirement plan.

What is a Long Term Care Annuity?

A long-term care annuity is a specialized type of annuity that includes a long-term care rider, allowing policyholders to use a portion of the annuity’s value to cover qualifying LTC expenses.

Unlike traditional long-term care insurance, which requires ongoing premium payments and follows a “use-it-or-lose-it” model, LTC annuities provide greater flexibility. If long-term care benefits go unused, the annuity’s value can be used as retirement income or passed to heirs.

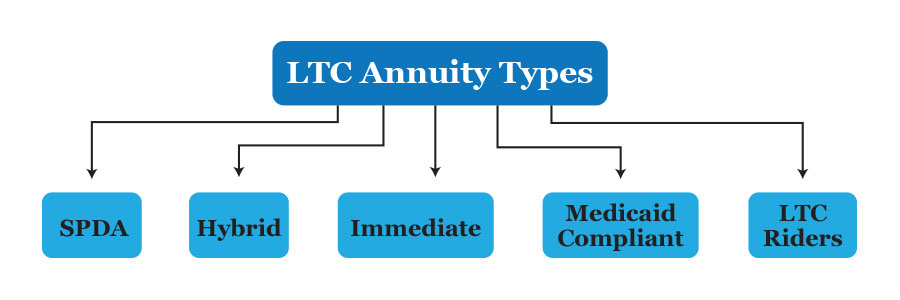

Types of Long Term Care Annuities

Long-term care annuities come in different forms, each designed to help retirees cover care costs while preserving their savings. The right option depends on factors like age, health, financial goals, and when you might need care.

- Single Premium Deferred Annuity (SPDA) with an LTC Rider – A one-time lump sum investment that grows tax-deferred while offering 2-3x the initial deposit in LTC benefits. It features guaranteed minimum interest rates, flexible access to funds, and can be used for income or inheritance if LTC isn’t needed.

- Hybrid Annuities (Combination of Income & LTC Benefits) – A mix between a traditional annuity and LTC protection, where part of the premium funds LTC benefits (2-3x the annuity value) and the rest provides income. If LTC isn’t needed, funds remain available for retirement income or heirs.

- Immediate Annuities with Long-Term Care Benefits – If you’re already in or near retirement and need care soon, this option provides guaranteed income right away. You make a one-time payment, and the annuity starts distributing monthly payments—which increase if you need long-term care.

- Annuities with Long-Term Care Riders – These are conventional annuities with optional long-term care benefit riders attached, usually for an additional fee. The rider activates when specific care triggers are met, providing supplemental benefits beyond the standard annuity payments.

- Medicaid-Compliant Annuities for LTC Planning – For those who might need Medicaid assistance in the future, Medicaid-compliant annuities can help protect assets while qualifying for government benefits. These annuities convert savings into structured income, ensuring you meet Medicaid’s strict asset limits.

How Does a Long Term Care Annuity Work

While all annuities provide a stream of income, an annuity with long term care rider offers enhanced benefits.

- Initial Investment – Long-term care annuities typically require a $50,000 to $500,000 in a lump sum, funded via retirement accounts, savings, or a 1035 exchange. If you’re planning to retire with $500k or any other amount, an LTC annuity can help you maximize its longevity.

- Benefit Triggers and Qualification – To qualify for withdrawals, policyholders generally must be diagnosed with an inability to perform at least two out of six Activities of Daily Living (ADLs) (such as bathing, dressing, or eating) or have cognitive impairment (e.g., Alzheimer’s or dementia).

- Benefit Periods and Payout Structures – Unlike traditional annuities with fixed payments, an LTC annuity allows larger withdrawals for long-term care over 2-6 years or even lifetime benefits. Monthly payouts are based on either a percentage of the annuity value or a multiple of standard income payments.

- Tax Implications – One of the biggest advantages of LTC annuities is their tax-free benefits for qualified care expenses, thanks to the Pension Protection Act of 2006—a key benefit over liquidating other investments that may incur capital gains or income taxes.

- Required Minimum Distribution Considerations – For qualified retirement accounts, required minimum distributions (RMDs) still apply when funds are used to purchase long-term care annuities. However, the structure of these products can sometimes be advantageous in RMD planning, particularly when designed to align with specific tax situations.

- Death Benefits and Unused Benefits – A distinctive feature of long-term care annuities is that unused benefits retain value. If the annuitant passes away without using the long-term care benefits, beneficiaries typically receive the remaining annuity value or a guaranteed minimum death benefit, depending on the specific contract terms.

- Underwriting Considerations – Long-term care annuities have simplified underwriting, often requiring only a brief health questionnaire instead of a medical exam. This makes them a great option for those with health concerns who may not qualify for traditional LTC insurance.

Key Considerations When Choosing an LTC Annuity

Selecting the most appropriate long-term care annuity requires careful analysis of both the product features and your personal circumstances. The following considerations can help guide your decision-making process:

- Benefit Triggers & Qualification – Most long-term care annuities include an elimination (waiting) period before benefits begin, typically ranging from 0 to 100 days. Shorter elimination periods increase access to benefits but may reduce the overall benefit amount or increase costs. Review the specific benefit triggers, ensuring they align with industry standards for ADL impairments and cognitive decline.

- Growth Potential & Interest Rates – Many LTC annuities provide guaranteed interest rates and tax-deferred growth, with some multiplying the initial investment (2-3x) for long-term care, offering greater financial leverage for future needs.

- Inflation Protection – Since long-term care costs often outpace inflation, inflation protection is key, especially for younger buyers. Options include simple interest (e.g., 3% annually) or compound adjustments, with the latter offering stronger but costlier coverage.

- Tax Implications – The funding source for your premium (qualified retirement accounts vs. non-qualified funds) affects the tax treatment of both the premium payment and future benefits. Qualified funds may face RMD requirements, while non-qualified funds can sometimes offer more favorable tax treatment for benefits.

- Contract Flexibility & Access to Funds – Consider how the annuity accommodates changing circumstances. Key flexibility factors include:

- The ability to access funds for non-LTC needs in emergencies

- Options for joint coverage with a spouse

- International coverage provisions

- Home modification benefits

- Premium return options if you change your mind

- The transferability of benefits

- Carrier Reputation and Financial Stability – The issuing insurance company’s financial strength is vital, as your benefits may not be needed for decades. Check ratings from A.M. Best, Moody’s, S&P, and Fitch, along with their claims payment history and customer reviews.

- Exit Strategy and Surrender Terms – Understand the consequences of terminating the contract early. Review the surrender charge schedule, which typically declines over time (e.g., 10% in year one, decreasing by 1% annually). Some contracts offer return of premium options after a specified period, which can provide valuable flexibility.

Ready to take the next step? Our team of specialized financial advisors can provide personalized guidance on how long-term care annuities might fit into your comprehensive retirement plan.

Key Takeaways: Planning for Long-Term Care with Annuities

- LTC annuities provide a dual benefit—tax-deferred savings growth and enhanced payouts for long-term care (2-3x the initial investment).

- Unlike traditional LTC insurance, annuities ensure your money isn’t lost if care isn’t needed—funds can be used for retirement income or passed to heirs.

- There are multiple LTC annuity options, including SPDA, hybrid, immediate annuities, and Medicaid-compliant annuities, each suited to different financial needs.

- Benefit triggers and payout structures vary, so reviewing elimination periods, inflation protection, and contract flexibility is crucial.

- Tax advantages make LTC annuities attractive, with tax-free benefits for qualified care expenses and tax-deferred growth, preserving more of your wealth.

- Choosing the right provider matters—evaluating carrier ratings, financial stability, and contract terms is essential for long-term security.

- A well-structured LTC annuity can protect assets and provide peace of mind, ensuring you’re financially prepared for potential care needs without draining retirement savings.

The long-term care annuity landscape continues to evolve, with insurers introducing more flexible benefits, enhanced inflation protection, and consumer-focused features to better meet retirees’ needs.

Failing to include LTC in your list of retirement expenses can disrupt even the best financial plans.

No matter your situation, an LTC annuity can help you preserve your wealth, protect your retirement, and gain peace of mind for the years ahead. Conducting a portfolio evaluation can help determine if an LTC annuity is the right fit for your financial plan.