As we transition through the various stages of life, our financial needs are also constantly evolving. The Institute of Financial Wellness examines the various stages of financial life and the decisions and investments you should consider during each one.

The Young Professional Stage

In the first few years after completing college, typically from ages 22 through 27, the young professional is busy navigating their first “real world” career opportunity. These will likely be the lowest income-earning years of your career, with a lot of competing needs and goals for the limited dollars available. As a young professional, one should start to consider and potentially begin purchasing the basic insurance coverages including life insurance, disability insurance, and auto insurance before transitioning to the young family stage.

Basic Budgeting

A crucial part of being a young professional is learning basic budgeting. This can be as simple as knowing how much you are earning each month, how much money is being taken for taxes and other deductions, and how much you have left to spend. A lot of people entering the workforce may be told they are making a certain amount in salary but fail to consider the taxes that will be removed before receiving each paycheck. Student debt is often a large expense during the first years of one’s professional life.

Basic Protection

Young professionals also need to master the concept of basic protection. That means being proactive to build a fund of 3 to 6 months of normal expenses in case of an unexpected emergency. That could be anything from your car needing a major repair to a large medical expense that insurance does not cover to losing your job. Unexpected things in life happen to everyone…but by understanding basic protection and acting on the concept, you can be in a position to make sure emergencies do not disrupt your entire financial plan.

The Young Family Stage

The young family stage of your financial life ideally builds on the young professional stage, even if you have not actually started a family. By the time you have reached your upper 20s or lower 30s, you will want to be completely sure your 3 to 6-month emergency reserve is built and is not being touched. In this phase, you are hopefully earning more money than in the young professional stage and have a comfortable amount of discretionary income. During the young family stage of life, it is time to start refining the protections considered during the young professional stage of financial life to ensure they are still relevant for your financial needs. This is the time to reassess life insurance, plus disability and auto insurance coverages for you and your young family.

“Protection First” Mindset

This stage of your financial life is key for taking a look at the protections, i.e., insurance, that you have in place for yourself and your family. Perhaps you selected the most inexpensive health insurance plan when you were young and single but now have other health concerns or dependents to consider. If you have purchased your first house, you will need to make sure that your house, which is probably the most valuable asset you own, is properly insured. Life insurance, disability insurance, and auto insurance are also major considerations in this stage.

In the young family stage, adopting a “protection first” mindset may be difficult at first since it also requires spending more money each month. Once you have mastered it, however, you can look to begin to ramp up your retirement planning in earnest. This is a key phase of one’s financial life to make sure you are taking advantage of your employer’s retirement plan, especially any matching 401K funds. This is “free” money on top of your salary and should not be left on the table except under the most extreme circumstances.

The Pre-Retiree/Retiree Stage

In the pre-retiree stage of your financial life, you are about 10 years away from retirement. If you have invested in volatile products such as stocks, whether on your own or through your employer’s retirement plan, this phase often requires adopting a new mindset with a lower risk tolerance and risk capacity. However, if you’ve saved enough money, you are still far enough away from retirement to withstand an especially up or down year in the market.

When the time comes to actually retire, hopefully, you have checked the boxes of every previous stage of your financial life and have enough money to feel comfortable with your decision.

Estate Planning and Healthcare Directives

First things first, everyone should have an estate plan. It’s not something anyone really ever wants to think about, but it’s incredibly important for yourself and your family. Having an estate plan will specifically determine who gets which of your assets, along with when and how they receive them. If you die without an estate plan, the laws of your individual state will dictate how your assets are distributed.

Besides having an estate plan, you need to ensure you have established healthcare directives for your family. Again, this is something no one ever wants to think about but is crucial for your loved ones. Don’t leave it to your children or spouse to have to make the tough decisions about what could be your final days. Having healthcare directives will take those decisions out of their hands and give them peace of mind that the doctors are doing what they want.

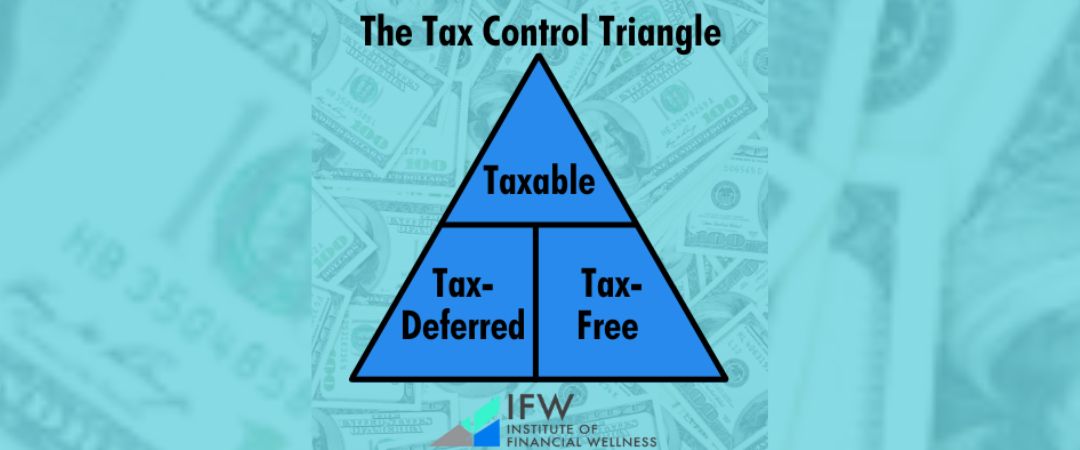

The Tax Control Triangle

No matter which stage of financial life you are in, The Institute of Financial Wellness wants to make sure you understand the tax control triangle. This simple structure shows you the three places your money can go and the tax implications of each.

Tax-Deferred

At the bottom left of the tax control triangle is tax-deferred money. This is the most well-known retirement savings vehicle and a place where all pre-retirees should be holding some of their assets. When you invest money tax-deferred, you are not paying any taxes now but will rather pay them later. This can be a great financial benefit for when you find yourself in a lower income tax bracket in retirement. However, most tax-deferred money is not completely liquid, meaning you will be subject to penalties and additional taxes for withdrawing the funds outside of the prescribed time frames. Therefore, it is important not to overload the tax-deferred portion of the triangle.

Taxable

At the top of the tax control triangle are taxable dollars. This is earned money such as interest and dividends that you will pay ordinary income tax rates on. You will also owe tax on any capital gains that you earn over the course of a tax year. Unlike tax-deferred funds, all taxable money is entirely liquid, meaning you can always use it when you want and how you want.

Tax-Free

At the bottom right of the tax control triangle is tax-free money. This is when you invest income that you’ve already paid income taxes on into a product in a tax-free bucket. This commonly includes Roth IRAs and Roth 401Ks. All money invested in these products grows tax-deferred, and when you make distributions, they will be completely tax-free.

Ideally, you want to have money in all three pieces of the tax control triangle and make sure you are deferring taxes at your highest income levels to get the highest potential tax breaks later in your financial life.

Investment Products

Finally, successfully navigating through all stages of your financial life means having at least a basic understanding of the investment products available to you. These include:

Stocks

Stocks are pieces of ownership of publicly traded companies with the price going up or down based on performance. Stocks tend to be volatile and perform best over the long term, so investing in stocks requires a high-risk tolerance.

Bonds

Bonds are the opposite of stocks and are where you are lending money to a company that promises to pay you a stated rate of interest and later return your original investment. Unlike stocks, you do not participate in any upside yet have less chance of losing your money entirely if the company goes out of business.

Mutual Funds

Mutual funds are a great way to take small dollars and have them diversified. You can be invested in hundreds of stocks and/or bonds at one time, all managed by professionals.

Managed Money

Managed money involves hiring an advisor or a team for a fee to manage your entire portfolio to your risk tolerance, time, objective, etc.

Annuities

Annuities come in various styles, such as fixed, fixed index, and variable. For example, in a fixed annuity, you are investing your money in a product that promises to pay a fixed rate of interest for a specified period of time, i.e., 30 years. This is different from bonds as annuities provide tax deferral of interest earned until you take money out.

Life Insurance

Last but not least, life insurance is an investment product that protects the money you do not already have. If something happens to you that affects your ability to earn income, including death, life insurance will replace that money for your loved ones, who will continue to depend on it.

Contact The Institute of Financial Wellness Today!

We can provide financial education and resources customized to your current or future financial stage of life. Don’t guess which investments are the best for you right now, or listen to someone who does not have your best interests in mind. We offer complimentary and confidential consultations to help get you started. Contact us today to schedule yours and get on the right track to financial wellness now!