“The best time to start saving for retirement is when you’re young. The second best time is today.” – Chris Hogan

Are you considering guaranteed asset protection (GAP) insurance for your vehicle but unsure about what it really offers and if it’s necessary for you? GAP insurance safeguards your finances by covering the difference between the actual cash value of your vehicle and the remaining balance on your loan or lease in case of a total loss. Are you ready? We’ll provide you with a thorough understanding of GAP, illustrate when it’s crucial for your asset protection, and assist you in making an informed choice regarding its purchase.

Don’t forget to calculate your retirement score today with the Institute of Financial Wellness.

Key Takeaways

- GAP insurance is an optional coverage designed to cover the remaining balance of an auto loan if the insurance payout after a total loss or theft does not match the amount still owed.

- Factors such as vehicle depreciation, the down payment amount, loan terms, and negative equity carried over from previous loans may influence the need for GAP insurance.

- GAP insurance costs can vary depending on the provider, with dealerships typically charging more, but the overall expense can be higher if financed with interest through an auto loan rather than paid upfront.

Decoding Guaranteed Asset Protection (GAP)

Gap insurance, also known as Guaranteed Asset Protection (GAP), is a specialized insurance product that protects your vehicle’s assets. It ensures coverage for the difference between your auto loan balance and your vehicle’s depreciated value if it becomes totaled or stolen. Essentially, this form of gap coverage acts as an added layer of financial security, settling any outstanding loan amounts left after you receive an insurance payout and may even extend to cover your insurance deductible.

The Basics of GAP Coverage

Gap insurance acts as an adjunct to your comprehensive or collision policy. It comes into play when the value of your vehicle, diminished by depreciation, is less than what you still owe on your auto loan in the event that your car is declared a total loss or stolen. Essentially, this type of coverage serves to bridge the monetary gap between the payout from collision insurance and what you still have outstanding on your loan [1].

Nevertheless, it’s important to understand that any compensation from GAP insurance hinges on specific criteria that take into account the amortization schedule of your loan rather than simply relying on the valuation of your vehicle given by your primary insurer.

Why GAP Matters: The Depreciation Factor

GAP insurance is crucial due to the depreciation aspect. On average, a new vehicle experiences an estimated 20% decrease in value within its initial year and then continues to diminish at a rate of about 15% to 20% each year for the subsequent four or five years [2]. As this swift loss in value typically exceeds the pace of your auto loan repayment, a monetary gap emerges that GAP insurance is designed to address.

Types of Vehicles Covered by GAP

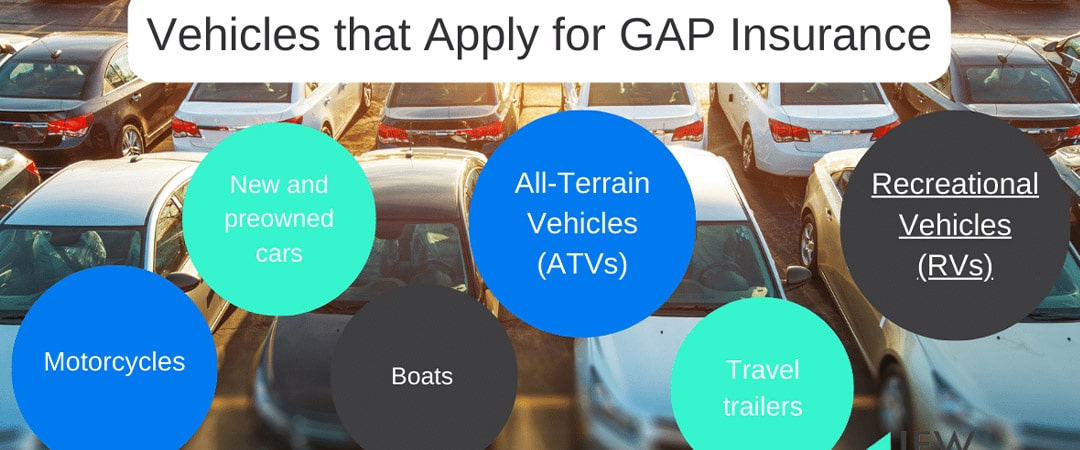

GAP insurance, often referred to as gap covers, is applicable to a wide variety of vehicle categories, such as:

- Both new and pre-owned cars

- Motorcycles

- Boats

- All-Terrain Vehicles (ATVs)

- Travel trailers

- Recreational Vehicles/Motorhomes (RVs)

To qualify for GAP insurance coverage, vehicles typically must not exceed two or three model years of age [3].

Evaluating Your Need for GAP Insurance

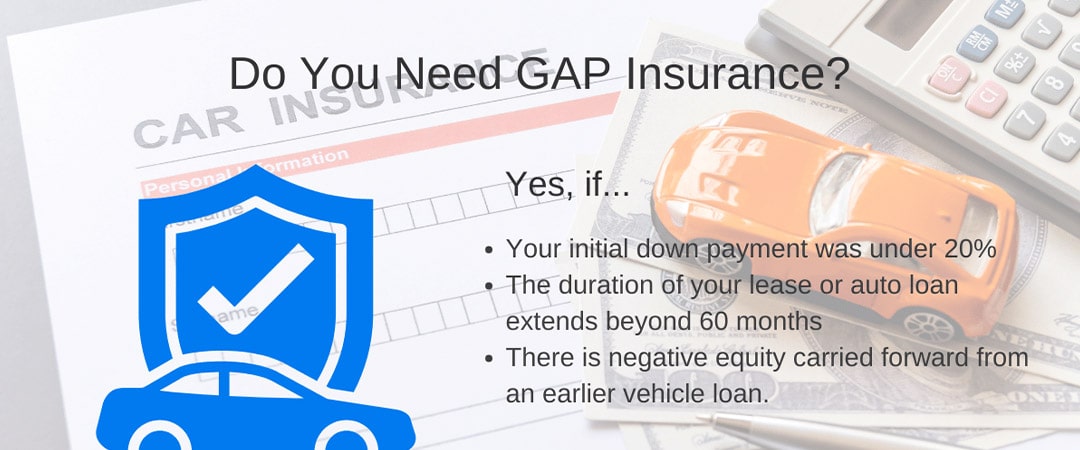

Having gained a clearer insight into GAP insurance, it’s worth considering its potential value to your situation. This type of insurance might be advantageous if:

- Your initial down payment was under 20%

- The duration of your lease or auto loan extends beyond 60 months

- There is negative equity carried forward from an earlier vehicle loan.

In scenarios where you face a total loss without GAP coverage, you could end up with no vehicle and still owe a significant amount on your car loan or lease.

Comparing Loan Balance vs. Car’s Value

The necessity for GAP insurance can be assessed by contrasting the amount you owe on your loan with your vehicle’s market value. It’s advisable to consider GAP insurance when the loan balance is near or exceeds what your vehicle is currently worth. To determine if you have negative equity, which necessitates this type of insurance, subtract the market value of your car—appraised through resources like Kelley Blue Book or Edmunds—from the outstanding amount of your loan.

Analyzing Risk: Accident and Theft Statistics

When assessing the necessity of GAP insurance, it is critical to consider statistics related to theft and accidents. Thieves more frequently target newer vehicles, which amplifies the significance of obtaining GAP coverage for recent models. Vehicle varieties that boast greater performance tend to be involved in collisions at a higher frequency, underscoring the importance of including gap insurance in one’s overall insurance protection plan.

Remember that financial advisors from The Institute of Financial Wellness can help you better understand how GAP insurance works and how you can take advantage of it.

The Cost-Benefit Analysis of GAP Insurance

Comprehending the financial trade-offs involved with GAP insurance is vital for an informed choice. The cost of this insurance fluctuates. Auto insurers usually impose a yearly fee ranging from $20 to $40, whereas dealers and lenders might apply a one-time charge of about $500 to $700. This charge may also accrue interest if it’s consolidated into the vehicle loan.

How Much Does GAP Insurance Cost?

Gap insurance is an additional coverage that can be included with your auto insurance policy. Speaking, the cost of gap insurance may range from $20 to $40 annually if it’s added to your existing vehicle insurance plan [4]. Several elements could affect this cost:

- The real cash value of the vehicle

- The location where the vehicle is parked or stored

- How old the vehicle is

- The history of claims made by the driver under their auto insurance

Financing GAP: Lump Sum vs. Payments

You have the option of paying for GAP insurance in one lump sum or including it in your regular auto loan payments. Choosing to pay the entire cost upfront can be less expensive since you won’t accrue interest charges over time.

Alternatively, folding the cost into your auto loan allows you to spread out the expense. This may increase total costs because interest will accumulate on the insurance premium throughout the duration of the loan.

Securing GAP Insurance: Where and How to Purchase

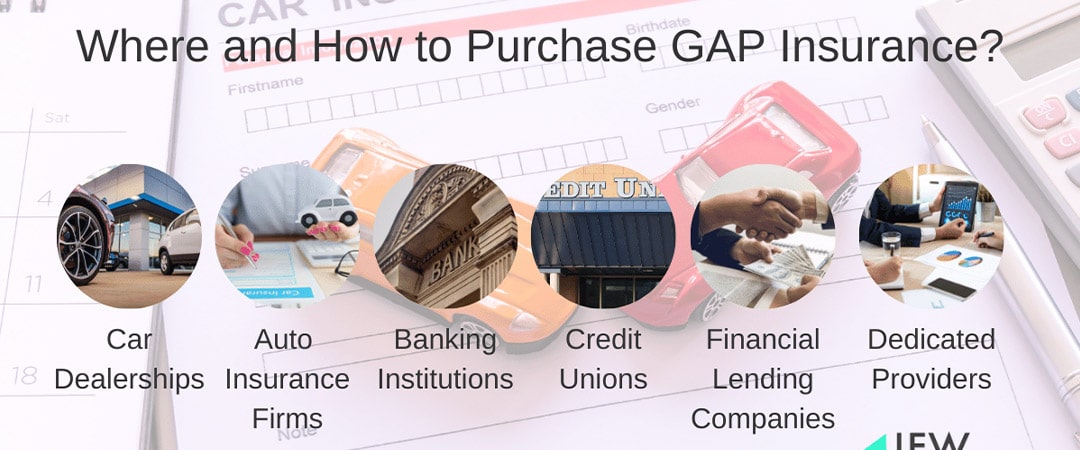

Understanding GAP insurance, its necessity, and the process of assessing its value for money is essential. If you decide to purchase gap coverage, there are several avenues to obtain it from, such as:

- Car dealerships

- Auto insurance firms

- Banking institutions

- Credit unions

- Financial lending companies

- Dedicated providers specializing in GAP insurance

Purchasing from an Auto Dealer vs. Insurance Company

When contemplating the acquisition of GAP coverage, it is crucial to consider the advantages and disadvantages associated with purchasing gap insurance from either a car dealership or an insurance company. Opting for a car dealer might offer convenience and possible bundled deals. Their prices tend to be steeper. To those offered by conventional insurance providers.

Conversely, choosing an insurance company for your purchase of gap coverage can lead to more advantageous pricing strategies along with tailored options that suit individual needs when it comes to this specific type of insurance.

GAP Waiver vs. GAP Insurance Policy

Regrettably, the details provided did not adequately distinguish between a GAP insurance policy and a GAP waiver. Nevertheless, it is advised to thoroughly scrutinize the terms of any insurance product before committing to its purchase. A financial advisor can help you make a smart decision, such as the team at The Institute of Financial Wellness.

Maximizing the Value of GAP Coverage

After securing a gap policy it’s crucial to optimize its value. Grasping the specifics and limitations within your agreement is vital, along with being aware of the appropriate measures to undertake should your vehicle become implicated in an incident or encounter theft.

Understanding the Terms and Exclusions

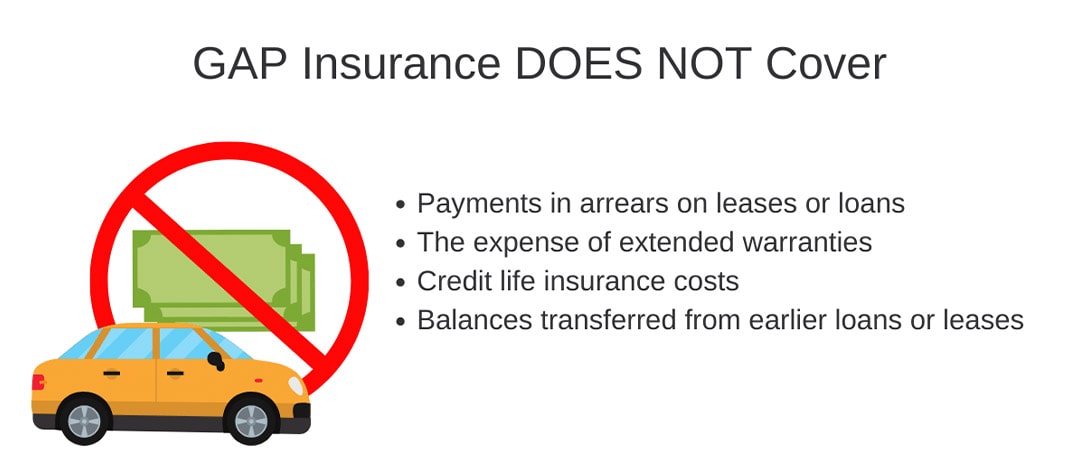

Understanding the limitations of GAP insurance is crucial, as it does not extend to every situation. Specifically, it will not provide coverage for:

- Payments in arrears on leases or loans

- The expense of extended warranties

- Credit life insurance costs

- Balances transferred from earlier loans or leases

If your primary insurer applies deductions for issues such as wear and tear, pre-existing damage, towing services, or storage fees – these are also not covered by gap insurance.

What to Do in Case of an Accident or Theft

Should your vehicle suffer significant damage or total loss due to an accident, theft, fire, or vandalism, GAP insurance is designed to cover the financial gap between the car’s depreciated value and what you still owe on your loan. Securing a report from the police or fire department in instances of theft, fire, or vandalism is vital for substantiating your GAP insurance claim.

Navigating Claims with GAP Insurance

When facing the challenging situation of an accident or theft, managing a GAP insurance claim may seem overwhelming. Through effective communication with your auto insurance company and grasping how to deal with valuation differences, you can more easily steer through the procedure.

Coordinating with Your Auto Insurance Company

In the process of submitting a GAP claim, it’s vital to work in tandem with your auto insurance company. This involves furnishing several necessary documents, including the GAP Deficiency Waiver Addendum, your financing agreement, and a record of loan payments. Be mindful that privacy regulations may necessitate you obtaining specific documents on your own, as GAP insurers often don’t possess immediate access to them due to these legal constraints.

Handling Discrepancies in Valuation

When a gap arises due to the primary insurance company assessing your car’s market value as lower than your outstanding loan balance, GAP insurance steps in. This type of coverage is designed to cover the difference between your insurance payout and what you still owe on the loan.

Additional Considerations When Choosing GAP

Opting for GAP insurance requires grasping its essence and determining if it’s necessary, as well as considering other elements like the effect on interest rates, the overall expenses of the loan, and policies regarding refunds and cancellations. Don’t forget to ask your trusted financial advisor for more information if you’re considering GAP insurance!

Impact on Interest Rates and Loan Costs

Incorporating GAP insurance into your auto loan may influence the total expense of the loan. Opting to pay for GAP insurance upfront in one lump sum can reduce costs, but rolling the premium into your auto loan could result in increased costs as a consequence of accruing interest on that added amount.

Refunds and Cancellations

Grasping the refund and termination terms for your GAP insurance is crucial. This type of protection provides a complete reimbursement within 60 days following its acquisition, and typically, insurers will return money for any part of the policy that remains unused if you sell your car or no longer require the coverage.

Closing the Gap: Navigating Financial Health with The Institute of Financial Wellness

In your journey to enhance your financial health, The Institute of Financial Wellness (IFW) stands with you as a dedicated partner. We offer:

- In-depth instruction on finances

- A suite of tools and services

- Educational content about finance that is both interactive and impartial

- Connections to a community of Financial Professionals for all financial matters.

With the support from IFW, you’ll receive:

- Continuous advice and backing designed to optimize lifelong financial triumphs

- Captivating instruction on fiscal matters

- Personalized strategies fully put into action to meet distinctive requirements

The IFW equips individuals with the power they need to achieve their optimal financial existence. Contact a financial advisor today and take a look at our retirement roadmap on-demand webinar!

Full Summary

GAP insurance is an essential financial tool that can protect you from unexpected financial losses due to car accidents or theft. Understanding its terms, exclusions, and claim process can help you maximize its benefits, while considering factors such as its cost, the need based on your auto loan balance and car value, and additional considerations such as its impact on interest rates and loan costs can guide you in making an informed decision. Remember, financial wellness is a journey, and it’s never too late to start.

Frequently Asked Questions

What is a guaranteed asset protection product?

In the event of theft or a total loss, Guaranteed Asset Protection (GAP) offers insurance coverage to safeguard your investment in your vehicle by covering the difference if your loan or lease balance exceeds the settlement from your insurance company.

Is API insurance worth it?

Indeed, acquiring API insurance is beneficial as it aids in resolving outstanding vehicle finance if your car is stolen or deemed a total loss. This ensures you’re not left to pay the discrepancy to the finance company [5].