“Wealth is the product of man’s capacity to think.” -Ayn Rand

Did you know that there are land investments with tax benefits? That’s right, and they may be the opportunity you were looking for as a good investment that can increase your retirement score.

Investors find that land can offer significant tax advantages, including deductions, exemptions, and deferrals, all contributing to a stronger financial strategy. Let’s unpack these benefits, showing you how land investment can help shield your income and enhance wealth management.

Key Takeaways

- Rural land ownership offers significant tax savings. Some are reductions or deferrals in property taxes, capital gains tax exemptions, and deductions for land maintenance and improvements, helping wealthy investors to increase their financial security and prosperity.

- Tax benefits of rural land extend to depreciation deductions on developments. Also, passive income exemptions from FICA taxes, opportunity zone investments, and favorable capital gains treatments in 1031 like-kind exchanges, contributing to wealth accumulation and strategic financial planning.

- Thorough record-keeping and consulting with tax professionals are crucial for maximizing the tax advantages of land investments. Resources like the Institute of Financial Wellness provide valuable financial education to individuals on a wide array of investment and planning topics.

Unlocking the Hidden Wealth of Rural Land: Peace, Profit, and Tax Perks

Imagine escaping the chaos of city life and finding tranquility in the countryside. But there’s more to rural land than just peace and quiet.

Savvy investors have long recognized that owning rural property isn’t just about enjoying scenic views; it’s a smart move in the world of finance and asset management.

Rural land ownership offers a blend of serenity and significant financial perks. It’s a strategic asset that extends beyond its picturesque charm, providing substantial tax incentives and long-term financial benefits.

This isn’t just a hobby for the wealthy; it’s a key component of their broader fiscal strategies.

Whether it’s fertile fields ripe for farming or vast wilderness ideal for recreation, rural land holds immense potential. It can generate income, provide capital gains advantages, and offer hefty property tax deductions.

In this space, astute investors skillfully navigate both the landscape and the complexities of tax laws to reap the maximum benefits from their rural investments.

Owning rural land is more than just an escape—it’s a pathway to financial growth and stability.

Understanding Land Investment Tax Benefits

Are you ready to delve into the economic potential of land investments? It requires a thorough comprehension of the existing tax perks.

A real estate investor stepping into vacant land ownership is greeted with numerous tax benefits crafted to strengthen their financial position.

Some noteworthy tax incentives associated with investing in vacant lands are:

- Potentially lower or deferred property taxes

- Exemptions from capital gains taxes for certain kinds of land investments

- Write-offs pertaining to expenses incurred through maintaining and improving the owned parcel

By leveraging these advantages, investors can amplify profits while simultaneously reducing taxable obligations when channeling funds into raw land.

Every phase, from acquiring undeveloped terrain to executing strategic exits from said assets, can be fine tuned for optimal fiscal prudence. A savvy player in the field who exploits these given taxation privileges not only preserves but has an opportunity to expand wealth over time.

This discourse aims to dissect various ways in which owning empty lots enhances one’s chances for improved outcomes concerning taxation affairs.

Property Tax Savings on Vacant Land

The realm of land investment is interwoven with tax advantages, where property taxes on vacant land play an essential role. Important aspects to consider about these taxes include:

- The total amount paid in property taxes for vacant land can be deducted.

- Such deductions are free from the constraints of net investment income limits.

- The act of buying vacant land enables you to employ those property taxes as a strategic method to lower your overall taxable income.

Deducting property taxes when it comes to vacant land brings several benefits specifically geared toward individuals investing in such assets:

- These deductions exceed the restrictions that apply to primary residences and offer investors more leeway in protecting their income against taxation.

- They facilitate postponing the payment of certain taxes, which assists in maintaining your available funds.

- This deduction also serves as a means to amplify the financial efficiency within one’s real estate investments.

Capital Gains Strategies for Landowners

Navigating the world of taxes can feel like finding a hidden path. When it comes to selling land, smart owners know that understanding the difference between short-term and long-term capital gains can make a big difference in their tax bills.

Selling land you’ve held for less than a year means facing higher short-term capital gains taxes. But if you’ve held onto it for more than a year, you’ll pay less in long-term capital gains taxes. This difference can significantly impact how much tax you owe when you sell.

Landowners who choose wisely to capitalize on their yearly property expenses can lower the taxable income from their land investments. This strategy is ideal for long-term assets like land and ensures that when it’s time to sell, not only will you benefit financially, but your capital gains taxes will also be kept to a minimum.

Legal and Accounting Perks

Tax benefits can really pay off for smart land investors who understand the financial perks of owning property. One big advantage is the ability to deduct interest on land investments, which can significantly reduce your taxable income if used wisely.

Even if you don’t itemize deductions, you can still employ savvy tax strategies. By capitalizing on carrying costs, you can strategically lower your taxable income and handle your taxes with ease.

Navigating Depreciation Deductions for Land Investors

Land itself doesn’t depreciate, but the buildings and improvements you put on it can offer great tax savings. If you’re a land investor adding commercial buildings or other improvements, you can use depreciation deductions to lower your taxable income significantly.

This means less tax to pay now and potentially moving into a lower tax bracket, offering more economic benefits.

Whether you’ve built a large commercial property or invested in items like appliances and maintenance equipment, these assets lose value over time. The IRS recognizes this through depreciation deductions on your tax returns.

By taking advantage of these deductions, you can gradually reduce your tax liabilities each year, making it a smart strategy for financial growth and effective tax management.

Depreciation of Commercial Buildings on Land

Depreciation for commercial properties is a process that consistently lowers taxable income, improving your financial outlook. By spreading out the building’s cost over its IRS-determined useful life, owners can deduct a portion each year, easing their income tax obligations.

This is especially significant for large properties worth millions, as annual depreciation deductions can substantially reduce taxable income.

Buildings that meet energy efficiency standards qualify for additional tax breaks, further enhancing financial benefits. Constructing sustainable, energy-efficient structures is a smart tax strategy, revealing incentives like the 179D deduction for those embracing eco-friendly real estate practices.

Residential Rental Property Depreciation

Depreciation helps lower taxable income for commercial properties, which is great for your finances. Owners can spread out the building’s cost over its IRS-designated useful life, deducting a portion each year to ease their income tax burden.

This is particularly advantageous for high-value properties, where yearly depreciation deductions can significantly reduce taxable income.

If your buildings meet energy efficiency standards, you can get even more tax benefits. Building sustainable, energy-efficient structures is a savvy tax move that reveals incentives like the 179D deduction for those who adopt eco-friendly practices.

Passive Income Potential and Tax Implications

The appeal of earning income passively is irresistible, and for those who own land, this can be actualized through the effective utilization of their property. By leasing out their holdings for varied uses, proprietors can harvest consistent, untaxed earnings. Such passive revenue benefits from being exempt from FICA taxes and qualifies for deductions that pass-through entities enjoy—proving to be an efficient method for maintaining wealth.

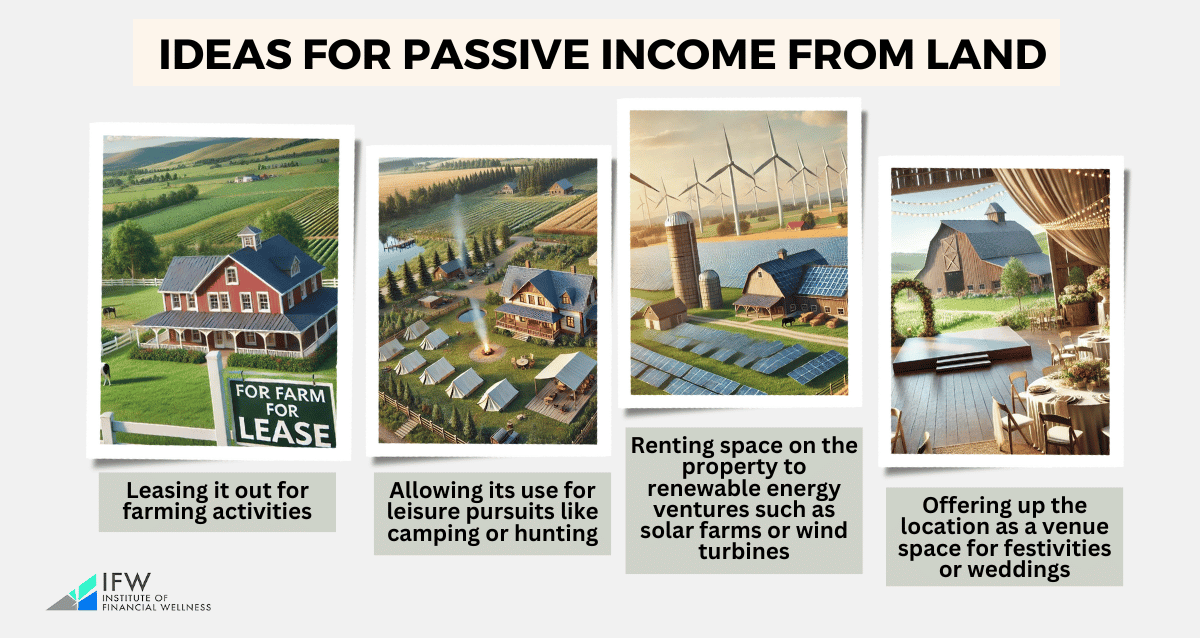

Landowners have multiple avenues to derive passive profits from their lands by:

- Leasing it out for farming activities

- Allowing its use for leisure pursuits like camping or hunting

- Renting space on the property to renewable energy ventures such as solar farms or wind turbines

- Offering up the location as a venue space for festivities or weddings

Delving into these possibilities enables owners to transform mere ownership into a lucrative asset, bringing in steady gains without ongoing personal effort.

Embracing such financial opportunities signifies much more than just welcoming additional cash flow—it’s indicative of how robust an investment holding land can be. Not only do owners benefit financially, but they also sidestep significant tax impositions common with other types of revenue streams.

This distinctive feature associated with owning land establishes a crucial pillar within one’s economic plans, ensuring continual revenues that are metaphorically as rich and bountiful as the very earth itself.

Leasing Land for Agriculture or Recreation

Investing in land offers a range of opportunities to generate passive income. Idle fields can turn into steady revenue sources when they become desirable for agriculture or recreation.

Landowners can lease their property to farmers for crop cultivation under the sun or to outdoor enthusiasts for activities like hunting. Each use highlights the flexible and profitable nature of owning land.

This investment not only ensures a reliable income stream but also strengthens one’s financial foundation for retirement. It’s a smart blend of financial foresight and environmental stewardship, recognizing and capitalizing on the aesthetic appeal and wealth-building potential that comes with land ownership.

Renewable Energy Initiatives

Investing in land intersects with the growing trend of renewable energy projects, linking income generation with environmental conservation. Landowners who lease their property for solar or wind projects harness natural resources to create a reliable source of passive income.

This strategic approach combines economic foresight with environmental responsibility, allowing landowners to contribute to the planet’s health while bolstering their financial security.

Defer Taxes with Land Investment Incentives

What else does land investment offer? We can mention numerous opportunities for those seeking to defer tax payments.

One key strategy is the 1031 exchange, which allows investors to reinvest sale proceeds into new real estate investments and defer paying capital gains taxes. Another avenue is investing in opportunity zones, where gains can potentially be deferred and partially excluded from taxes over time, thanks to recent federal program enhancements.

Understanding these options allows investors to leverage various tax incentives and deductions to their advantage, paving the way for enhanced financial prosperity. These strategies aren’t just about temporary tax relief; they serve as essential steps toward building long-term financial stability and supporting continuous wealth growth while minimizing tax liabilities.

Opportunity Zone Investments

Investing in Opportunity Zones unveils one of the investment world’s best-kept secrets, offering substantial tax advantages brimming with potential. By directing capital gains into Qualified Opportunity Funds, investors enjoy the benefit of deferring taxes, allowing their investments to grow unimpeded until a specified date.

This strategic approach not only fosters economic growth but also enhances an investor’s financial portfolio.

Over time, tax incentives within these zones escalate, starting with exclusions that increase from 10% to 15% and potentially culminating, after ten years, in the elimination of capital gains taxes on any appreciation gained from the investment. This forward-thinking strategy aligns well with the patient nature of land investments, ensuring that today’s financial decisions pave the way for even brighter financial prospects in the future.

Securing Financial Security Through Long-Term Land Investment

Long-term financial security often begins with investing in real estate, particularly through land. The lasting value of land as a finite resource provides investors with a stable asset amid changing economic conditions.

Offering potential for passive income and substantial appreciation over time, land ownership is a cornerstone of sound financial planning, accessible and promising for those who pursue it.

With its low-risk profile, investing in land attracts investors seeking wealth growth. Historically, the appreciation of undeveloped land often exceeds that of developed properties.

Adopting a ‘buy and hold’ strategy fits seamlessly with land investment, allowing investors to benefit from increasing land values with minimal effort. This solidifies land investments as a reliable source of financial security for the future, offering fertile ground for sustained portfolio growth.

Appreciation and Property Value Growth

The value of land appreciates steadily due to the fundamental principle of supply and demand. As land becomes scarcer and demand increases, the investment’s worth rises, often surpassing that of developed properties.

This enduring trend highlights the lasting value and stability of raw land unaffected by market fluctuations.

Taking a long-term approach to land ownership requires patience and strategic foresight. While buildings may deteriorate over time, the inherent value of land remains intact.

This characteristic—its potential to fetch higher prices upon future sale—is what makes investing in land so compelling. It silently yet powerfully builds wealth for those who hold ownership of these pieces of our planet.

Estate Planning and Inheritance Benefits

In estate planning and inheritance, long-term investment in land offers distinct advantages. Heirs not only inherit the property itself but also benefit financially from a stepped-up basis.

This adjustment sets the value of the land to its current market rate, alleviating concerns about capital gains taxes. As a result, the wealth accumulated from the land can be transferred without being reduced by tax liabilities.

The Comprehensive Guide to Reporting and Paying Taxes on Land Investments

Owning land involves both potential profit and the responsibility to accurately report financial activities and pay taxes. Navigating through tax complexities is crucial for land investors to stay compliant while maximizing available tax benefits.

Using Schedule A for itemized deductions and Schedule E to report income or losses from properties on Form 1040 is essential for a sound fiscal strategy.

With changes introduced by the Tax Cuts and Jobs Act, it’s vital for individuals to understand how these updates impact their finances when buying, selling, or owning property. Understanding the implications of various taxes—such as property taxes and income taxes—on your investment portfolio facilitates better planning and a holistic approach to managing land investments.

Record-Keeping Best Practices

Record-keeping stands as the base of any robust tax strategy. It’s essential to systematically document every expenditure associated with land investment, particularly legal and accounting fees.

These records are vital not only for substantiating deductions but also for providing a strong defense during an audit process.

With proper documentation, costs incurred from daily operations, property management services, and interest can be deducted effectively—lessening one’s taxable income.

Precise bookkeeping empowers investors by allowing them to:

- Incrementally increase the cost basis of their land through strategic expense allocation

- Optimize available tax advantages

- Ensure ongoing financial vitality within their portfolio

This methodical practice is demanding yet rewards investors with enhanced monetary efficiency and potential reductions in overall taxation. Through careful calculations of net investment income, they position themselves strategically to capitalize on tax benefits while sustaining the economic wellness of their investments.

Overall, conscientious tracking allows you not just evidence-based support for claims but also leverages your ability to:

- Amplify expenses onto your land’s base value, cutting down gain taxed at sale.

- Fully exploit possible fiscal preferences related exclusively to taxes.

- Make certain that your collective venture holdings remain prosperous over time.

Understanding Your Tax Situation

No two land investments are alike, and neither are their tax implications. That’s why it’s essential for each investor to consult with a tax professional to gain a clear understanding of their individual tax situation.

The landscape of tax law is ever-changing, and what applies to one investor might not apply to another. By working with a tax professional, investors can navigate the complexities of their tax obligations and identify ways to maximize their tax benefits.

Factors such as local market conditions, tax laws, and zoning regulations all play a role in shaping an investor’s tax situation. The guidance of a tax professional can help land investors adapt to these factors, ensuring that they are making the most informed decisions for their financial future.

It’s a partnership that offers clarity and confidence, allowing investors to focus on the growth of their land investments while resting assured that they are in compliance with current tax laws.

Charting Financial Success: The Institute of Financial Wellness Guides Your Path to Prosperity

As a beacon for those sailing the extensive sea of financial planning and investments, the Institute of Financial Wellness (IFW) is dedicated to delivering engaging and unbiased financial education. Our aim is to arm individuals with essential knowledge that empowers them to realize financial prosperity and relish an optimal life.

We set ourselves apart by offering a valuable combination of tools such as e-newsletters, webinars, such as The Retirement Score Webinar, video-on-demand services, and special features. All these instruments are designed specifically to cater to diverse elements crucial for one’s financial well-being.

With our robust network comprising seasoned professional financial advisors, resource partners, and influential thought leaders boasting over 35 prestigious certifications and accreditations collectively, our guidance stands at unparalleled levels of excellence. It covers various critical areas, including retirement preparation strategies, pathways for college savings plans, and choices surrounding insurance—all aiming at ushering in both lucidity and assurance into each act of fiscal determination-making.

Approaching this expedition toward achieving long-term economic stability should be not only fruitful but also enjoyable—the IFW ensures just that through stimulating educational methods tailored individually according to each person’s unique circumstances.

Full Summary

In the realm of wealth management, the ownership of rural land stands as a bastion of opportunity, offering a plethora of tax savings and financial benefits. From the substantial deductions on property taxes to the strategic advantages in capital gains and the potential for passive income, land ownership is a canvas on which the savvy investor can paint a future of prosperity.

With the right knowledge and professional guidance, the journey of land investment can lead to significant financial security and a legacy that endures.

See How You Can Boost Your IFW Retirement Score

When you request your IFW Retirement Score, an IFW Certified Financial Professional will help you discover ways to:

Lower or potentially eliminate taxes in retirement

Protect your retirement portfolio

Secure a stable income stream throughout retirement

Frequently Asked Questions

What distinguishes short-term from long-term capital gains taxes for landowners?

Profits derived from assets that are held for a period shorter than one year are subject to short-term capital gains taxes, which align with the rates of standard income tax.

On the other hand, land investors benefit from a more advantageous tax scenario when it comes to long-term capital gains. These apply to profits on assets maintained for over a year and are subjected to reduced taxation rates.

Can land itself be depreciated for tax purposes?

For tax purposes, the land cannot undergo depreciation. It is only the improvements or structures that are situated on the land, like buildings or significant capital investments, which are eligible for depreciation.

How do 1031 exchanges benefit land investors?

Land investors can gain a substantial financial edge through 1031 exchanges, which permit them to postpone paying capital gains taxes, renew the depreciation timeline, and possibly broaden their investment holdings diversely without facing immediate tax consequences.

What are Opportunity Zones, and how do they affect land investment taxes?

Opportunity Zones offer preferential tax treatment for investments in economically distressed communities. By reinvesting capital gains into these zones, investors can defer taxes and potentially exclude a portion or all of the appreciation from capital gains taxes in the long term.

Why is record-keeping important for land investors?

For land investors, maintaining accurate records is crucial as it enables them to take advantage of deductions, furnishes essential documentation in the event of audits, and aids in minimizing taxable profit upon the sale of the property.

What are farmland investment returns?

Over the last 20 years, U.S. farmland has offered average returns of 12.75%. If you had invested $10,000 in farmland in 2002, it would now be worth over $105,904. These returns include both land appreciation and capitalization rates of the property [1].

What is direct farmland investment?

One way to invest in farmland is to directly purchase usable cropland or pastureland and rent it out to farmers or ranchers. This approach allows you to benefit from land appreciation and rental income [2].

What are the pros of holding land as a long-term investment?

Historically, land appreciates about 10-14% annually, making it a great strategy for building long-term wealth [3].