Where is Your Money Taking You?

Learn how to make your money work for you. Discover tips and insights for smarter financial decisions that lead to a secure and happy retirement. Start planning for the retirement of your dreams!

Posts — Category: Retirement Planning

What is a Profit-Sharing Plan?

While choosing from the various kinds of retirement plans available, an employer or a company can choose a profit-sharing plan to provide retirement benefits for its employees. What is a Profit-Sharing Plan?

Extend Your Retirement Budget with the Gig Economy

Retirement savings need to last longer than ever. The good news is that retirees are not only living longer; they are also leading happier, more active, and energetic lifestyles than

Additional Financial Home Buying Obligations

You have found your dream home in the perfect neighborhood for you and your family. You have even determined that you will be able to afford the monthly mortgage payments

Don't miss out on our retirement planning insights

Down Payment Strategies for First-Time Home Buyers

The idea of buying a first home is exciting. However, coming up with a sizable down payment can feel like an impossible task. That is especially true when many lenders

Getting Your Retirement Back on Track

The one-two punch dealt by the Great Recession of 2007-2009, followed by economic damage from the COVID-19 pandemic may have done real damage to your retirement savings. It also does not take

Working in Retirement

The traditional view of retirement is changing, and it is changing quickly. For example, retirement was when you could travel or spend long days with your grandchildren. These days, however,

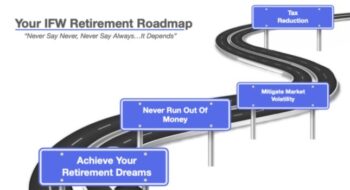

Planning Your Retirement Roadmap

Pros of Planning Your Retirement Roadmap Retirement is an exciting time for those that are exiting the workforce and looking forward to spending quality time with their families and loved