Where is Your Money Taking You?

Learn how to make your money work for you. Discover tips and insights for smarter financial decisions that lead to a secure and happy retirement. Start planning for the retirement of your dreams!

Posts — Category: Investment Strategies

What You Can Do To Protect Your Retirement By Battling Inflation

Inflation can be a sneaky villain, trying to steal away your retirement savings without you even noticing. But don’t worry – there are ways that savvy savers like yourself can

What is a Profit-Sharing Plan?

While choosing from the various kinds of retirement plans available, an employer or a company can choose a profit-sharing plan to provide retirement benefits for its employees. What is a Profit-Sharing Plan?

Managing Your Child Care Expenses

Most people preparing for their first baby are shocked and even dismayed to learn just how high childcare costs can be. According to Care.com’s 2021 Cost of Care survey, weekly

Buying vs Renting a Home

Does it make more sense to rent than to buy? That has been a long-running debate in this country. However, the question is flawed: There is no correct answer. There

Don't miss out on our retirement planning insights

Employed Again? Do These Things First

As the pandemic continues, unemployment rates have begun to decrease. According to the Bureau of Labor, as of November 2021, the unemployment rate was at 4.2 percent. So, if you

Fixed Rate vs Adjustable Rate Mortgages

You are ready to apply for a mortgage. Your question? Should you take out a fixed-rate loan or an adjustable rate? As with most mortgage questions, there is no one correct

15-Year vs 30-Year Mortgages

What makes more sense financially for you, a 15-year fixed-rate mortgage or a 30-year fixed-rate mortgage? Both loan types come with their positives and negatives. So how do you determine which

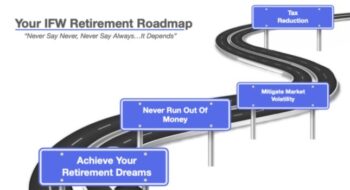

Planning Your Retirement Roadmap

Pros of Planning Your Retirement Roadmap Retirement is an exciting time for those that are exiting the workforce and looking forward to spending quality time with their families and loved