Where is Your Money Taking You?

Learn how to make your money work for you. Discover tips and insights for smarter financial decisions that lead to a secure and happy retirement. Start planning for the retirement of your dreams!

Trending Categories: Retirement Planning Tax Planning Savings Strategies Investment Strategies Longevity & The Future

8 Things To Know About Annuities

Be mindful of the messenger that positions certain products or services as “always” bad or “always” perfect. The fact of the matter is there are no “bad products” or “perfect

What Is a 1035 Exchange?

According to the most recent information available, Americans have individual life insurance with a total face value of $12.4 trillion.1 Due to a variety of factors, these individuals may find

Inflation & Your Money

“If the current annual inflation rate is only 1.4 percent,1 why do my bills seem like they’re 10 percent higher than last year?” Many of us ask ourselves that question, and

Is Term Life Insurance for You?

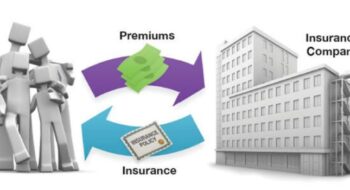

Term insurance is the simplest form of life insurance. It provides temporary life insurance protection on a limited budget. Here’s how it works: When a policyholder buys term insurance, they

Don't miss out on our retirement planning insights

What to Look for in a Long-Term Care Policy

Long-Term Care coverage can be complex. Here’s a list of questions to ask that may help you better understand the costs and benefits of these policies. What types of facilities

Consider Keeping Your Life Insurance When You Retire

Do you need a life insurance policy in retirement? One school of thought questions this decision. Perhaps your kids have grown and the need to help protect the household against

Term vs. Permanent Life Insurance

According to industry experts, most people don’t have enough life insurance. LIMRA, which keeps close tabs on the industry, recently reported that average coverage equals $163,000, which is equivalent to

Tax Efficiency in Retirement

Will you pay higher taxes in retirement? It’s possible. But that will largely depend on how you generate income. Will it be from working? Will it be from retirement plans?