If you’re nearing or in retirement and feeling overwhelmed about managing your finances, you’re not alone. You might be wondering if a financial advisor could be the key to unlocking peace of mind and securing your financial future. Rest assured, you’re in the right place. Financial advisors for retirees can help optimize your retirement income, plan for healthcare costs, and safeguard against financial pitfalls. For a personalized assessment, you can check your retirement score and consult a financial advisor.

Key Takeaways

- Retirement financial advisors provide specialized guidance on investment strategies, Social Security planning, and managing retirement withdrawals, ensuring a stable income and guarding against risks like inflation and market volatility.

- Working with a financial advisor offers numerous benefits, including personalized long-term strategies, comprehensive financial planning, and support during unexpected events, which can lead to improved financial stability and outcomes.

- Key services offered by retirement financial advisors include portfolio management, tax planning, estate planning, and long-term care planning, all essential for securing a comfortable retirement.

Understanding Financial Advisors for Retirees

A retirement financial advisor is a professional that shares insights into how to plan and manage finances as individuals transition into retirement. They provide guidance on various aspects of retirement preparations such as:

- Investment strategies

- Social Security planning

- Withdrawal planning.

Retirement financial advisors ensure a stable income throughout retirement by:

- Understanding current spending

- Planning for future needs

- Managing investments

These advisors are instrumental in optimizing income sources, crafting sustainable financial strategies, and guarding against risks such as inflation and market volatility.

The primary advantages of working with a retirement financial advisor include:

- Their profound insight, experience, and knowledge

- Tailored advice to meet unique retirement needs

- Help in developing withdrawal strategies that prevent premature depletion of savings

- Projections for future healthcare costs and strategies to allocate funds for these necessities

- Education about common scams and setting up safeguards to protect against financial scams and abuse

Benefits of Working with a Financial Advisor

Collaborating with a financial advisor offers numerous benefits, including the peace of mind that comes from knowing your financial future is in expert hands. Imagine the relief of having a personalized long-term strategy tailored to your specific goals and risk tolerance.

With comprehensive planning, you can protect your retirement income from tax inefficiencies and ensure a well-rounded financial plan that supports your dreams and aspirations.

Financial advisors also provide invaluable support in navigating unexpected events such as market dips or job loss by adapting strategies to maintain financial stability. They replace emotional reactions with reason during market fluctuations, encouraging a long-term investment mindset that can lead to better financial outcomes.

Establishing a long-term, trusted bond with an advisor can incrementally add value as they persistently provide bespoke guidance to enhance the quality of financial decisions.

Key Services Offered by Retirement Financial Advisors

Retirement financial advisors extend a range of essential services tailored to the unique needs of retirees. These services typically include:

- Portfolio management

- Tax planning

- Estate planning

- Long-term care planning

Each of these services plays a critical role in ensuring that retirees can enjoy a secure and comfortable retirement.

Portfolio Management

The crux of investment management for retirement income is to ensure that your savings yield sufficient income without the peril of outliving your assets. One of the crucial factors in managing assets during retirement is the initial amount of money available at the start.

Financial advisors help retirees by creating a balanced portfolio tailored to different stages of retirement that includes a mix of:

- Stocks

- Bonds

- Mutual funds

- Cash investments

For instance, a moderate asset allocation for early retirement years (ages 60-69) might consist of 60% stocks, 35% bonds, and 5% cash investments.

Striking a balance between preservation and growth is paramount to make the portfolio last for 30 years or more without being excessively conservative. Advisors recommend strategies such as:

- Building a bond ladder with staggered coupon and maturity dates to provide a steady income flow.

- Adding dividend-paying stocks to the portfolio can offer a regular stream of income with potential growth.

- A larger allocation of stocks in the early years helps protect against the risk of outliving retirement savings.

Another pivotal aspect of portfolio management is recalibrating investments to mirror shifts in risk tolerance and financial objectives. This includes reviewing asset allocation at least three years before retirement to adjust for new risks. By maintaining a disciplined approach to rebalancing, retirees can enhance portfolio performance over the long term.

Tax Planning

The goal of tax planning is to slash the tax bill, letting retirees keep more of their hard-earned money and maintain financial stability with a smart tax strategy.

Financial advisors play a crucial role in:

- Helping retirees navigate the complexities of tax laws

- Taxes on Social Security benefits

- Retirement account withdrawals

Limiting tax liability and penalties by:

- Identifying taxable accounts

- Staying updated with changing tax laws.

Retirement advisors also provide strategies to reduce taxable income through charitable giving, such as:

- Qualified Charitable Donations (QCDs)

- Donor Advised Funds (DAFs).

Choosing the right type of retirement account, whether a tax-deferred traditional IRA or a Roth IRA, is vital for effective tax planning. Mismanaging required minimum distributions (RMDs) from retirement accounts can result in penalties, so advisors help ensure these are calculated and taken correctly.

By reviewing the tax burden on various retirement income sources, including after tax contributions and estate taxes, advisors help retirees optimize their income during retirement by providing valuable tax advice. This comprehensive approach to tax planning ensures that retirees can enjoy their savings without undue stress from federal income tax.

Estate Planning

Estate planning is crucial to ensure that a retiree’s assets are distributed as per their wishes posthumously. Financial advisors help retirees safeguard retirement savings for loved ones and ensure their legacy is preserved by guiding them through the process of:

- Drafting wills

- Setting up trusts and marital deductions

- Organizing beneficiary designations and gift-giving strategies

Effective estate planning provides peace of mind knowing that your financial legacy will be handled as you desire. Advisors help manage these complex tasks, making sure all legal requirements are met and that the estate plan aligns with overall financial goals.

Long-Term Care Planning

Long-term care is a significant part of retirement planning, considering the substantial and unforeseen healthcare expenses. Retirement advisors can help you:

- Review various insurance options

- Develop plans to pay for potential long-term care expenses

- Ensure that retirees are not caught off guard by high medical costs

By considering long-term care needs early, retirees can avoid financial burdens later in life. Advisors help evaluate the best insurance policies and savings strategies to cover these expenses, providing a safety net that protects both the retiree’s health and wealth.

How to Choose the Right Financial Advisor for Retirement

Selecting the appropriate financial advisor for retirement is pivotal to guarantee you receive the most beneficial advice and support. Start by understanding the different types of financial advisors:

- Fee-only advisors, who typically act as fiduciaries and are legally obligated to act in your best interest, avoiding conflicts of interest.

- Commission-based advisors, who earn their income via commissions on the financial products they sell.

- Fee-based advisors, who may earn both fees and commissions.

Make an informed decision about which type of advisor is best suited to your needs with the following steps:

- Investigate the advisor’s fee structure to understand how you will be charged, whether it’s a percentage of assets, hourly rates, or flat fees.

- Ensure the advisor is a fiduciary and check their credentials, such as a CFP (Certified Financial Planner) designation, which signifies expertise in comprehensive financial planning.

- Research their background using tools like FINRA’s BrokerCheck and ask about the frequency and structure of meetings to ensure consistent communication and ongoing financial planning.

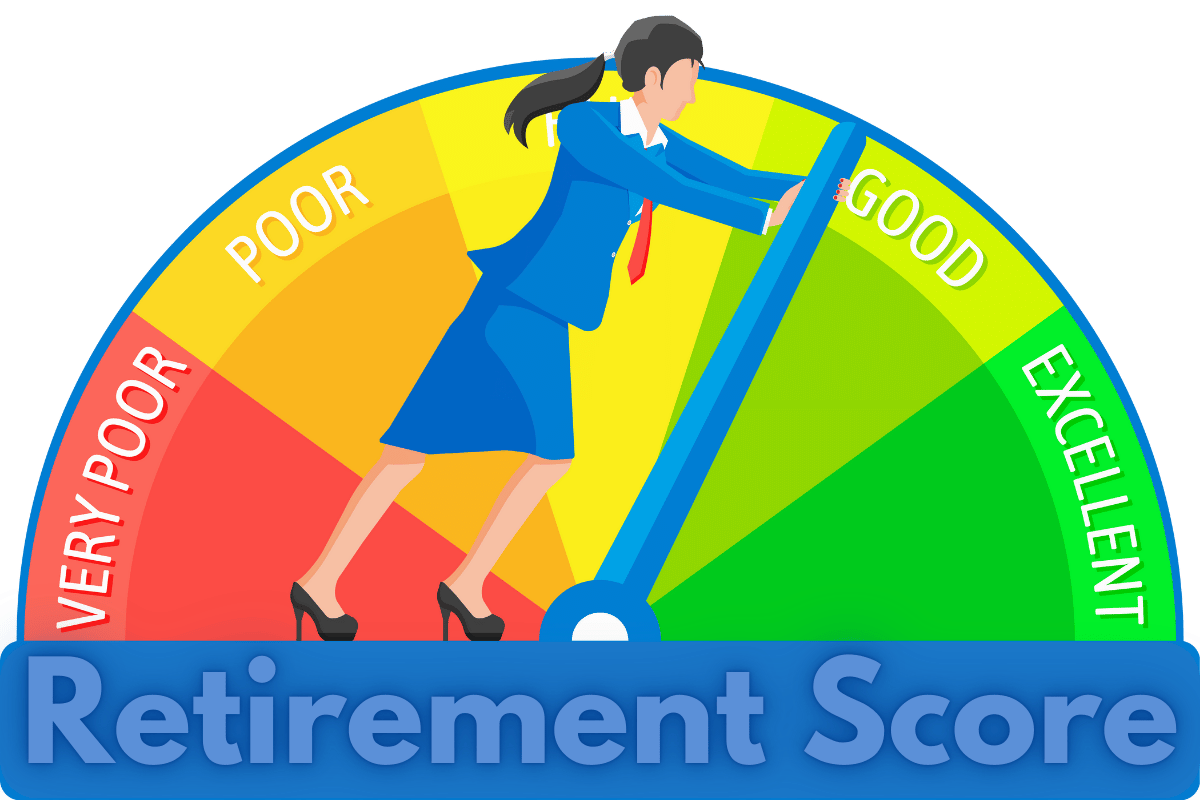

The IFW Retirement Score: A Tool for Assessing Your Retirement Readiness

The IFW Retirement Score is a powerful tool that gauges the likelihood of meeting your retirement income goals. This metric ranges from 0 to 100%, with higher scores indicating a better chance of success. It uses a Monte Carlo Simulation algorithm, considering factors like:

- Total assets

- Asset allocation

- Inflation rates

- Retirement income needs

- Tax obligations

By joining the IFW Retirement Roadmap Experience and consulting with an IFW Certified Financial Professional, you can:

- Receive your personalized retirement score

- Learn ways to reduce or eliminate taxes in retirement

- Protect your portfolio from market volatility

- Ensure a stable income stream

Remarkably, people can improve their retirement score 80% of the time, paving the way for a more secure financial future.

Pros and Cons of Hiring a Retirement Advisor

Balancing the pros and cons of hiring a retirement advisor is crucial in determining if it aligns with your financial goals and comfort level. It’s a decision that requires not just analysis, but also a heartfelt consideration of what brings you peace and security in your golden years.

On the positive side:

- Many retirees benefit from the specialized knowledge and personalized financial planning services that a dedicated retirement advisor provides.

- This expertise can lead to better financial decisions and a more secure retirement.

Downsides to consider:

- One major risk is the possibility of conflicts of interest, especially if the advisor is not a fiduciary and might recommend products that benefit them more than the client.

- High fees associated with some financial advisors can also significantly reduce a client’s retirement savings over time.

Summary

Working with a retirement financial advisor can provide invaluable support and guidance as you navigate the complexities of managing your finances during retirement. From portfolio management to tax and estate planning, these professionals offer tailored strategies to help you achieve your financial goals. By choosing the right advisor, you can enjoy a secure and comfortable retirement. Remember, the key to a successful retirement is careful planning and informed decision-making.

Frequently Asked Questions

What does a financial advisor do?

A financial advisor provides expert guidance on managing your finances, including investment strategies, retirement planning, tax planning, and estate planning. They help you create a personalized financial plan to achieve your long-term goals.

How do I choose the right financial advisor for retirement?

To choose the right financial advisor for retirement, consider their credentials, fee structure, and whether they act as a fiduciary. Look for advisors with a CFP (Certified Financial Planner) designation and check their background using tools like FINRA’s BrokerCheck.

What are the benefits of working with a financial advisor?

Working with a financial advisor offers numerous benefits, including personalized financial strategies, comprehensive planning, and support during unexpected events. They help you make informed decisions, optimize your retirement income, and protect against financial risks.

How much does it cost to hire a financial advisor?

The cost of hiring a financial advisor varies based on their fee structure. They may charge a percentage of assets under management, hourly rates, or flat fees. It’s important to understand the fee arrangement before engaging their services.

Can a financial advisor help with tax planning?

Yes, financial advisors can help with tax planning by identifying strategies to reduce your tax liability, such as optimizing retirement account withdrawals, charitable giving, and managing taxable accounts. They help ensure you maximize your income while minimizing taxes in retirement.